Google 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

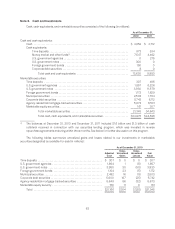

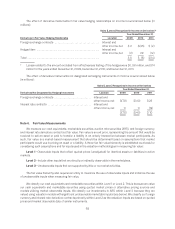

As of December 31, 2010, we did not have any investments in marketable securities that were in an unrealized

loss position for 12 months or greater.

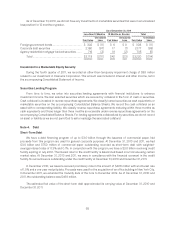

As of December 31, 2011

Less than 12 Months 12 Months or Greater Total

Fair Value Unrealized

Loss Fair Value Unrealized

Loss Fair Value Unrealized

Loss

Foreign government bonds ...................... $ 302 $ (11) $ 6 $ 0 $ 308 $ (11)

Corporate debt securities ....................... 2,160 (97) 17 (1) 2,177 (98)

Agency residential mortgage-backed securities .... 716 (3) 19 (2) 735 (5)

Total ..................................... $3,178 $(111) $42 $(3) $3,220 $(114)

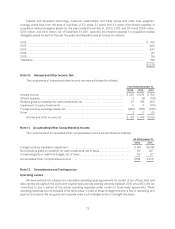

Investment in a Marketable Equity Security

During the fourth quarter of 2011, we recorded an other-than-temporary impairment charge of $88 million

related to our investment in Clearwire Corporation. This amount was included in interest and other income, net in

the accompanying Consolidated Statement of Income.

Securities Lending Program

From time to time, we enter into securities lending agreements with financial institutions to enhance

investment income. We loan selected securities which are secured by collateral in the form of cash or securities.

Cash collateral is invested in reverse repurchase agreements. We classify loaned securities as cash equivalents or

marketable securities on the accompanying Consolidated Balance Sheets. We record the cash collateral as an

asset with a corresponding liability. We classify reverse repurchase agreements maturing within three months as

cash equivalents and those longer than three months as receivable under reverse repurchase agreements on the

accompanying Consolidated Balance Sheets. For lending agreements collateralized by securities, we do not record

an asset or liability as we are not permitted to sell or repledge the associated collateral.

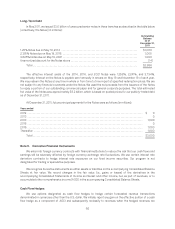

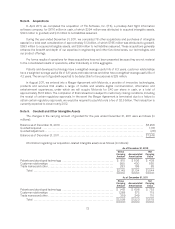

Note 4. Debt

Short-Term Debt

We have a debt financing program of up to $3.0 billion through the issuance of commercial paper. Net

proceeds from this program are used for general corporate purposes. At December 31, 2010 and 2011, we had

$3.0 billion and $750 million of commercial paper outstanding recorded as short-term debt with weighted-

average interest rates of 0.3% and 0.1%. In conjunction with this program, we have a $3.0 billion revolving credit

facility expiring in July 2016. The interest rate for the credit facility is determined based on a formula using certain

market rates. At December 31, 2010 and 2011, we were in compliance with the financial covenant in the credit

facility. No amounts were outstanding under the credit facility at December 31, 2010 and December 31, 2011.

In December 2010, we issued a secured promissory note in the amount of $468 million with an interest rate

of 1.0% and a one-year maturity date. Proceeds were used for the acquisition of an office building in New York City.

In December 2011, we extended the maturity date of the note to December 2012. As of December 31, 2010 and

2011, the outstanding balance was $468 million.

The estimated fair value of the short-term debt approximated its carrying value at December 31, 2010 and

December 31, 2011.

65