Google 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

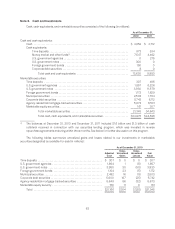

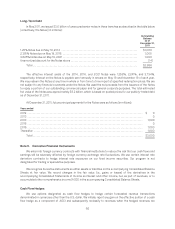

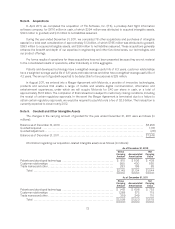

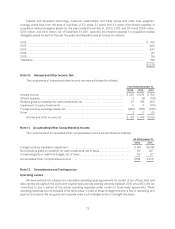

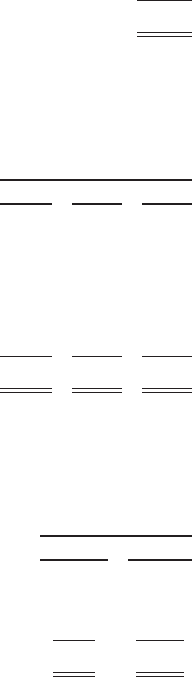

Patents and developed technology, customer relationships, and trade names and other have weighted-

average useful lives from the date of purchase of 5.0 years, 6.1 years, and 4.3 years. Amortization expense of

acquisition-related intangible assets for the years ended December 31, 2009, 2010, and 2011 was $266 million,

$314 million, and $441 million. As of December 31, 2011, expected amortization expense for acquisition-related

intangible assets for each of the next five years and thereafter was as follows (in millions):

2012 ......................................................................................... $ 472

2013 ......................................................................................... 364

2014 ......................................................................................... 297

2015 ......................................................................................... 147

2016 ......................................................................................... 99

Thereafter .................................................................................... 199

$1,578

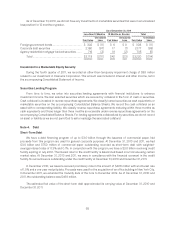

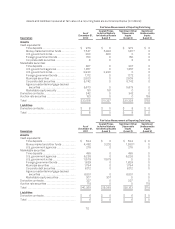

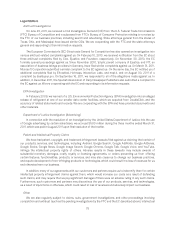

Note 10. Interest and Other Income, Net

The components of interest and other income, net were as follows (in millions):

Year Ended December 31,

2009 2010 2011

Interest income ................................................................ $230 $579 $ 812

Interest expense ............................................................... 0 (5) (58)

Realized gains on available-for-sale investments, net ............................... 97 185 254

Impairment of equity investments ................................................ 0 0 (110)

Foreign currency exchange losses, net ............................................ (260) (355) (379)

Other ......................................................................... 2 11 65

Interest and other income, net ............................................... $ 69 $ 415 $584

Note 11. Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income are as follows (in millions):

As of December 31,

2010 2011

Foreign currency translation adjustment ............................................... $(41) $(148)

Net unrealized gains on available-for-sale investments, net of taxes ....................... 94 327

Unrealized gains on cash flow hedges, net of taxes ...................................... 85 97

Accumulated other comprehensive income ............................................ $138 $ 276

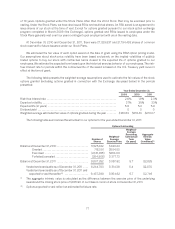

Note 12. Commitments and Contingencies

Operating Leases

We have entered into various non-cancelable operating lease agreements for certain of our offices, land, and

data centers throughout the world with original lease periods expiring primarily between 2012 and 2063. We are

committed to pay a portion of the actual operating expenses under certain of these lease agreements. These

operating expenses are not included in the table below. Certain of these arrangements have free or escalating rent

payment provisions. We recognize rent expense under such arrangements on a straight-line basis.

73