Google 2011 Annual Report Download - page 89

Download and view the complete annual report

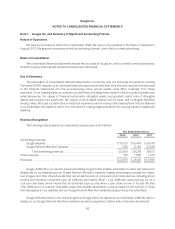

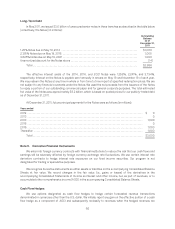

Please find page 89 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Long-Lived Assets Including Goodwill and Other Acquired Intangible Assets

We review property and equipment and intangible assets, excluding goodwill, for impairment whenever events

or changes in circumstances indicate the carrying amount of an asset may not be recoverable. We measure

recoverability of these assets by comparing the carrying amounts to the future undiscounted cash flows the assets

are expected to generate. If property and equipment and intangible assets are considered to be impaired, the

impairment to be recognized equals the amount by which the carrying value of the asset exceeds its fair market

value. We have made no material adjustments to our long-lived assets in any of the years presented. In addition, we

test our goodwill for impairment at least annually or more frequently if events or changes in circumstances

indicate that this asset may be impaired. Our tests are based on our single operating segment and reporting unit

structure. We found no goodwill impairment in any of the years presented.

Intangible assets with definite lives are amortized over their estimated useful lives. We amortize our acquired

intangible assets on a straight-line basis with definite lives over periods ranging from one to 12 years.

Income Taxes

We recognize income taxes under the liability method. We recognize deferred income taxes for differences

between the financial reporting and tax bases of assets and liabilities at enacted statutory tax rates in effect for the

years in which differences are expected to reverse. We recognize the effect on deferred taxes of a change in tax

rates in income in the period that includes the enactment date.

Foreign Currency

Generally, the functional currency of our international subsidiaries is the local currency. We translate the

financial statements of these subsidiaries to U.S. dollars using month-end rates of exchange for assets and

liabilities, and average rates of exchange for revenues, costs, and expenses. We record translation gains and losses

in accumulated other comprehensive income as a component of stockholders’ equity. We recorded $77 million of

net translation gains in 2009, $124 million of net translation losses in 2010, and $107 million of net translation

losses in 2011. We record net gains and losses resulting from foreign exchange transactions as a component of

interest and other income, net. These gains and losses are net of those realized on foreign exchange contracts. We

recorded $8 million of net gains in 2009, $29 million of net losses in 2010, and $38 million of net losses in 2011.

Advertising and Promotional Expenses

We expense advertising and promotional costs in the period in which they are incurred. For the years ended

December 31, 2009, December 31, 2010, and December 31, 2011, advertising and promotional expenses totaled

approximately $353 million, $772 million, and $1,544 million.

Recent Accounting Pronouncements

In June 2011, the FASB issued an amendment to an existing accounting standard which requires companies

to present net income and other comprehensive income in one continuous statement or in two separate, but

consecutive, statements. In addition, in December 2011, the FASB issued an amendment to an existing accounting

standard which defers the requirement to present components of reclassifications of other comprehensive income

on the face of the income statement. We adopted both standards in the fourth quarter of 2011.

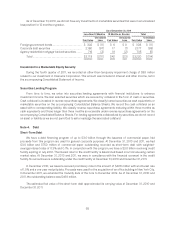

In September 2011, the FASB issued an amendment to an existing accounting standard, which provides

entities an option to perform a qualitative assessment to determine whether further impairment testing on goodwill

is necessary. Specifically, an entity has the option to first assess qualitative factors to determine whether it

is necessary to perform the current two-step test. If an entity believes, as a result of its qualitative assessment, that

it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, the quantitative

60