Google 2011 Annual Report Download - page 70

Download and view the complete annual report

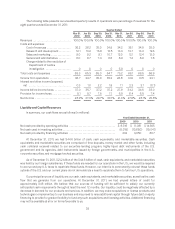

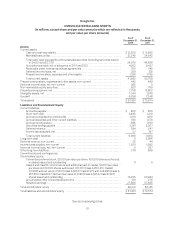

Please find page 70 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.award activities. In addition, the decrease in cash from changes in working capital activities primarily consisted of

an increase of $1,129 million in accounts receivable due to the growth in fees billed to our advertisers and an

increase of $414 million in prepaid revenue share, expenses and other assets. These increases were partially offset

by an increase in accrued expenses and other liabilities of $745 million, an increase in accounts payable of $272

million, an increase in accrued revenue share of $214 million, an increase in deferred revenue of $111 million, and a

net increase in income tax payable and deferred income taxes of $102 million, which includes the same $94 million

of excess tax benefits from stock-based award activities included under adjustments for non-cash items. The

increase in accrued expense and other liabilities, accounts payable, accrued revenue share, and deferred revenues

are primarily a result of the growth in our business and headcount. The increase in net income taxes payable and

deferred income taxes was primarily a result of additional tax obligations accrued, partially offset by the release of

certain tax reserves as a result of the settlement of our tax audits for our 2005 and 2006 tax years.

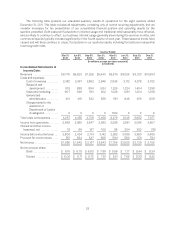

Cash provided by operating activities in 2009 was $9,316 million, and consisted of net income of $6,520

million, adjustments for non-cash items of $2,310 million, and cash provided by working capital and other activities

of $486 million. Adjustments for non-cash items primarily consisted of $1,240 million of depreciation and

amortization expense on property and equipment, $1,164 million of stock-based compensation expense, and $284

million of amortization of intangible and other assets, partially offset by $268 million of deferred income taxes on

earnings and $90 million of excess tax benefits from stock-based award activities. In addition, changes in working

capital activities primarily consisted of a decrease of $262 million in prepaid revenue share, expenses, and other

assets, an increase in accrued expenses and other liabilities of $243 million which is a direct result of the growth of

our business, and a net increase in income taxes payable and deferred income taxes of $217 million, which includes

the same $90 million of excess tax benefits from stock-based award activities included under adjustments for

non-cash items, and an increase in accrued revenue share of $158 million. These increases were partially offset by

an increase of $504 million in accounts receivable due to the growth in fees billed to our advertisers. The increase

in net income taxes payable and deferred income taxes was primarily a result of additional tax obligations accrued,

partially offset by an increase in the amount of estimated income taxes we paid during the year. The increase in

accrued revenue share was due to the growth in our AdSense and distribution programs and the timing of

payments made to our partners.

As we expand our business internationally, we have offered payment terms to certain advertisers that are

standard in their locales but longer than terms we would generally offer to our domestic advertisers. This may

increase our working capital requirements and may have a negative effect on cash provided by our operating

activities.

Cash used in investing activities in 2011 of $19,041 million was primarily attributable to net purchases of

marketable securities of $12,926 million, capital expenditures of $3,438 million related principally to our facilities,

data centers, and related equipment, and cash consideration used in acquisitions and other investments of $2,328

million, including $676 million paid in connection with the acquisition of ITA. Also, in connection with our securities

lending program, we returned $354 million of cash collateral. See Note 3 of Notes to Consolidated Financial

Statements included in Item 8 of this Annual Report on Form 10-K for further information about our securities

lending program.

Cash used in investing activities in 2010 of $10,680 million was primarily attributable to net purchases of

marketable securities of $6,886 million, capital expenditures of $4,018 million of which $1.8 billion was for the

purchase of an office building in New York City in December 2010, and remaining amounts related principally to

our data centers and related equipment, and cash consideration used in acquisitions and other investments of

$1,067 million. Also, in connection with our securities lending program, we received $2,361 million of cash

collateral which was invested in reverse repurchase agreements. Of the $2,361 million, $1,611 million was classified

as cash and cash equivalents, and $750 million was classified as receivable under reverse repurchase agreements

in the accompanying Consolidated Balance Sheet.

Cash used in investing activities in 2009 of $8,019 million was primarily attributable to net purchases of

marketable securities of $7,036 million and capital expenditures of $810 million.

41