Google 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

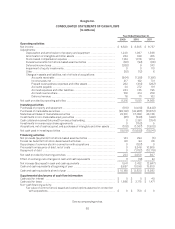

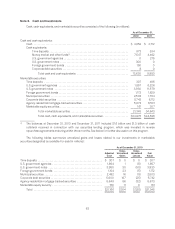

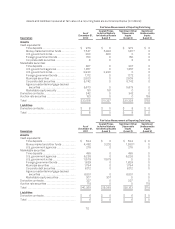

The following table sets forth the computation of basic and diluted net income per share of Class A and Class B

common stock (in millions, except share amounts which are reflected in thousands and per share amounts):

Year Ended December 31,

2009 2010 2011

Class A Class B Class A Class B Class A Class B

Basic net income per share:

Numerator

Allocation of undistributed earnings ............. $ 4,981 $ 1,539 $ 6,569 $ 1,936 $ 7,658 $ 2,079

Denominator

Weighted-average common shares outstanding . . 241,575 74,651 246,168 72,534 253,862 68,916

Less: Weighted-average unvested common

shares subject to repurchase or

cancellation .............................. (5) 0 0 0 0 0

Number of shares used in per share

computation ........................... 241,570 74,651 246,168 72,534 253,862 68,916

Basic net income per share ......................... $ 20.62 $ 20.62 $ 26.69 $ 26.69 $ 30.17 $ 30.17

Diluted net income per share:

Numerator

Allocation of undistributed earnings for basic

computation ............................... $ 4,981 $ 1,539 $ 6,569 $ 1,936 $ 7,658 $ 2,079

Reallocation of undistributed earnings as a result

of conversion of Class B to Class A shares ..... 1,539 0 1,936 0 2,079 0

Reallocation of undistributed earnings to Class B

shares ..................................... 0 (13) 0 (26) 0 (27)

Allocation of undistributed earnings ............. $ 6,520 $ 1,526 $ 8,505 $ 1,910 $ 9,737 $ 2,052

Denominator

Number of shares used in basic computation ..... 241,570 74,651 246,168 72,534 253,862 68,916

Weighted-average effect of dilutive securities .....

Add:

Conversion of Class B to Class A common

shares outstanding ................... 74,651 0 72,534 0 68,916 0

Unvested common shares subject to

repurchase or cancellation ............ 5 0 0 0 0 0

Employee stock options, including warrants

issued under Transferable Stock Option

program ............................ 2,569 114 3,410 71 2,958 46

Restricted shares and RSUs ............. 621 0 1,139 0 1,478 0

Number of shares used in per share

computation ...................... 319,416 74,765 323,251 72,605 327,214 68,962

Diluted net income per share ........................ $ 20.41 $ 20.41 $ 26.31 $ 26.31 $ 29.76 $ 29.76

The net income per share amounts are the same for Class A and Class B common stock because the holders of

each class are legally entitled to equal per share distributions whether through dividends or in liquidation.

62