Google 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

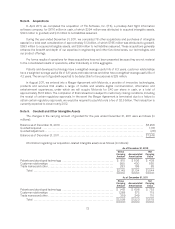

Note 8. Acquisitions

In April 2011, we completed the acquisition of ITA Software, Inc. (ITA), a privately-held flight information

software company, for $676 million in cash, of which $394 million was attributed to acquired intangible assets,

$323 million to goodwill, and $41 million to net liabilities assumed.

During the year ended December 31, 2011, we completed 78 other acquisitions and purchases of intangible

assets for a total cash consideration of approximately $1.3 billion, of which $795 million was attributed to goodwill,

$593 million to acquired intangible assets, and $86 million to net liabilities assumed. These acquisitions generally

enhance the breadth and depth of our expertise in engineering and other functional areas, our technologies, and

our product offerings.

Pro forma results of operations for these acquisitions have not been presented because they are not material

to the consolidated results of operations, either individually or in the aggregate.

Patents and developed technology have a weighted-average useful life of 6.3 years, customer relationships

have a weighted-average useful life of 6.6 years and trade names and other have a weighted-average useful life of

4.2 years. The amount of goodwill expected to be deductible for tax purposes is $29 million.

In August 2011, we entered into a Merger Agreement with Motorola, a provider of innovative technologies,

products and services that enable a range of mobile and wireline digital communication, information and

entertainment experiences, under which we will acquire Motorola for $40 per share in cash, or a total of

approximately $12.5 billion. The completion of this transaction is subject to customary closing conditions, including

the receipt of certain regulatory approvals. In the event the Merger Agreement is terminated due to a failure to

obtain certain regulatory approvals, we would be required to pay Motorola a fee of $2.5 billion. The transaction is

currently expected to close in early 2012.

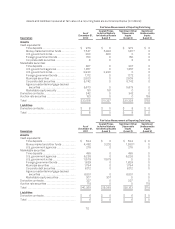

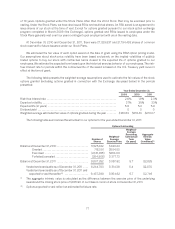

Note 9. Goodwill and Other Intangible Assets

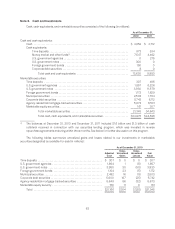

The changes in the carrying amount of goodwill for the year ended December 31, 2011 were as follows (in

millions):

Balance as of December 31, 2010 ............................................................... $6,256

Goodwill acquired ............................................................................. 1,118

Goodwill adjustment ........................................................................... (28)

Balance as of December 31, 2011 ................................................................ $7,346

Information regarding our acquisition-related intangible assets is as follows (in millions):

As of December 31, 2010

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology ....................................... $ 915 $506 $ 409

Customer relationships ................................................. 950 400 550

Trade names and other .................................................. 283 198 85

Total ............................................................. $2,148 $1,104 $1,044

As of December 31, 2011

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology ....................................... $ 1,451 $ 698 $ 753

Customer relationships ................................................. 1,288 573 715

Trade names and other .................................................. 359 249 110

Total ............................................................. $3,098 $1,520 $1,578

72