Google 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

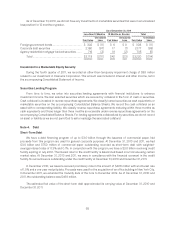

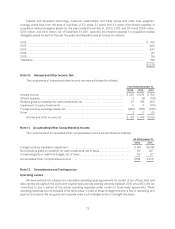

At December 31, 2011, future minimum payments under non-cancelable operating leases, net of sublease

income amounts, were as follows over each of the next five years and thereafter (in millions):

Operating

Leases Sub-lease

Income

Net

Operating

Leases

2012 ................................................................... $ 389 $17 $ 372

2013 .................................................................. 377 16 361

2014 .................................................................. 357 14 343

2015 .................................................................. 311 13 298

2016 .................................................................. 256 10 246

Thereafter .............................................................. 1,264 5 1,259

Total minimum payments ................................................ $2,954 $75 $2,879

Certain leases have adjustments for market provisions. Amounts in the above table represent our best

estimates of future payments to be made under these leases. In addition, the above table does not include future

rental income of $726 million related to the leases that we assumed in connection with our building purchases.

Rent expense under operating leases, including co-location arrangements, was $323 million, $293 million, and

$380 million in 2009, 2010, and 2011.

Purchase Obligations

We had $1.9 billion of other non-cancelable contractual obligations, primarily related to payments related to

certain of our distribution arrangements and video and other content licensing revenue sharing arrangements, as

well as data center operations and facility build-outs at December 31, 2011. In addition, we had $2.8 billion of open

purchase orders for which we had not received the related services or goods at December 31, 2011. We have the

right to cancel these open purchase orders prior to the date of delivery.

Letters of Credit

At December 31, 2011, we had unused letters of credit for $46 million.

Indemnifications

In the normal course of business to facilitate transactions of our services and products, we indemnify certain

parties, including advertisers, Google Network Members, and lessors with respect to certain matters. We have

agreed to hold certain parties harmless against losses arising from a breach of representations or covenants, or

out of intellectual property infringement or other claims made against certain parties. Several of these agreements

limit the time within which an indemnification claim can be made and the amount of the claim. In addition, we have

entered into indemnification agreements with our officers and directors, and our bylaws contain similar

indemnification obligations to our agents.

It is not possible to make a reasonable estimate of the maximum potential amount under these

indemnification agreements due to the unique facts and circumstances involved in each particular agreement.

Additionally, we have a limited history of prior indemnification claims and the payments we have made under such

agreements have not had a material adverse effect on our results of operations, cash flows, or financial position.

However, to the extent that valid indemnification claims arise in the future, future payments by us could be

significant and could have a material adverse effect on our results of operations or cash flows in a particular period.

As of December 31, 2011, we did not have any indemnification claims that we considered to be probable or

reasonably possible.

74