Google 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Although we believe we have adequately reserved for our uncertain tax positions, no assurance can be given

that the final tax outcome of these matters will not be different. We adjust these reserves in light of changing facts

and circumstances, such as the closing of a tax audit or the refinement of an estimate. To the extent that the final

tax outcome of these matters is different than the amounts recorded, such differences will impact the provision for

income taxes in the period in which such determination is made. The provision for income taxes includes the

impact of reserve provisions and changes to reserves that are considered appropriate, as well as the related net

interest.

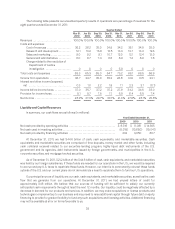

Our effective tax rates have differed from the statutory rate primarily due to the tax impact of foreign

operations, state taxes, certain benefits realized related to stock-based award activities, and research and

experimentation tax credits. The effective tax rates were 22.2%, 21.2%, and 21.0% for 2009, 2010, and 2011. Our

future effective tax rates could be adversely affected by earnings being lower than anticipated in countries that

have lower statutory rates and higher than anticipated in countries that have higher statutory rates, the net gains

and losses recognized by legal entities on certain hedges and related hedged intercompany and other transactions

under our foreign exchange risk management program, changes in the valuation of our deferred tax assets or

liabilities, or changes in tax laws, regulations, or accounting principles, as well as certain discrete items. In addition,

we are subject to the continuous examination of our income tax returns by the IRS and other tax authorities. We

regularly assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy

of our provision for income taxes.

Loss Contingencies

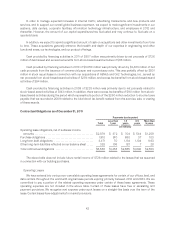

We are regularly subject to claims, suits, government investigations, and other proceedings involving

competition and antitrust, intellectual property, privacy, tax, labor and employment, commercial disputes, content

generated by our users, goods and services offered by advertisers or publishers using our platforms, and other

matters. Certain of these matters include speculative claims for substantial or indeterminate amounts of damages.

We record a liability when we believe that it is both probable that a loss has been incurred, and the amount can be

reasonably estimated. We evaluate, on a monthly basis, developments in our legal matters that could affect the

amount of liability that has been previously accrued, and make adjustments as appropriate. Significant judgment is

required to determine both likelihood of there being and the estimated amount of a loss related to such matters.

Until the final resolution of such matters, there may be an exposure to loss in excess of the amount recorded, and

such amounts could be material. Should any of our estimates and assumptions change or prove to have been

incorrect, it could have a material impact on our business, consolidated financial position, results of operations, or

cash flows. See Note 12 of Notes to Consolidated Financial Statements included in Item 8 of this Annual Report on

Form 10-K for additional information regarding contingencies.

Stock-Based Compensation

Our stock-based compensation expense for stock options is estimated at the grant date based on the award’s

fair value as calculated by the Black-Scholes-Merton (BSM) option pricing model and is recognized as expense

over the requisite service period. The BSM model requires various highly judgmental assumptions including

expected volatility and expected term. If any of the assumptions used in the BSM model changes significantly,

stock-based compensation expense may differ materially in the future from that recorded in the current period. In

addition, we are required to estimate the expected forfeiture rate and only recognize expense for those shares

expected to vest. We estimate the forfeiture rate based on historical experience and our expectations regarding

future pre-vesting termination behavior of employees. To the extent our actual forfeiture rate is different from our

estimate, stock-based compensation expense is adjusted accordingly.

Impairment of Marketable and Non-Marketable Securities

We periodically review our marketable securities and our non-marketable equity securities for impairment. If

we conclude that any of these investments are impaired, we determine whether such impairment is other-than-

temporary. Factors we consider to make such determination include the duration and severity of the impairment,

44