Google 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

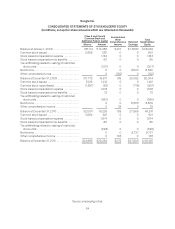

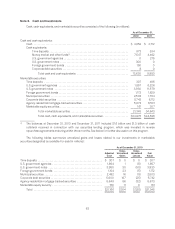

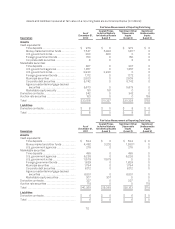

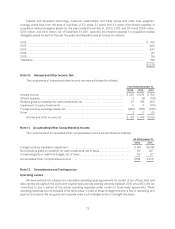

As of December 31, 2011

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Time deposits ................................................. $ 495 $ 0 $ 0 $ 495

U.S. government agencies ...................................... 6,211 15 0 6,226

U.S. government notes ......................................... 11,475 104 0 11,579

Foreign government bonds ..................................... 1,608 32 (11) 1,629

Municipal securities ............................................ 1,775 19 0 1,794

Corporate debt securities ....................................... 6,023 187 (98) 6,112

Agency residential mortgage-backed securities ................... 6,359 147 (5) 6,501

Marketable equity securities .................................... 228 79 0 307

Total .................................................... $34,174 $583 $(114) $34,643

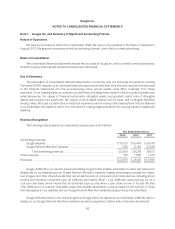

Gross unrealized gains and losses on cash equivalents were not material at December 31, 2010 and

December 31, 2011.

We recognized gross realized gains of $212 million and $381 million for the years ended December 31, 2010

and 2011. We recognized gross realized losses of $27 million and $127 million for the years ended December 31,

2010 and 2011. We determine realized gains or losses on the sale of marketable securities on a specific

identification method, and we reflect such gains and losses as a component of interest and other income, net, in

our accompanying Consolidated Statements of Income.

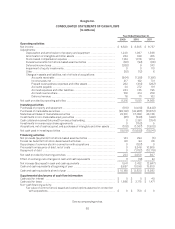

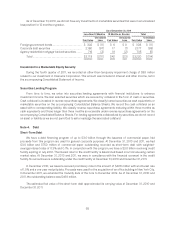

The following table summarizes the estimated fair value of our investments in marketable securities,

excluding the marketable equity securities, designated as available-for-sale and classified by the contractual

maturity date of the securities (in millions):

As of

December 31,

2011

Due in 1 year .............................................................................. $13,242

Due in 1 year through 5 years ............................................................... 7,482

Due in 5 years through 10 years ............................................................. 5,525

Due after 10 years ......................................................................... 8,087

Total ................................................................................ $34,336

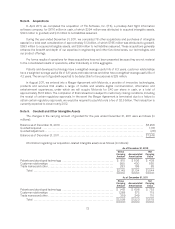

The following tables present gross unrealized losses and fair values for those investments that were in an

unrealized loss position as of December 31, 2010 and 2011, aggregated by investment category and the length of

time that individual securities have been in a continuous loss position (in millions):

As of December 31, 2010

Less than 12 Months

Fair Value Unrealized

Loss

U.S. government agencies ......................................................... $ 831 $ (8)

U.S. government notes ............................................................ 2,225 (50)

Foreign government bonds ........................................................ 129 (5)

Municipal securities .............................................................. 962 (5)

Corporate debt securities ......................................................... 1,061 (25)

Agency residential mortgage-backed securities ...................................... 1,675 (32)

Total ....................................................................... $6,883 $(125)

64