Google 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In order to manage expected increases in internet traffic, advertising transactions, and new products and

services, and to support our overall global business expansion, we expect to make significant investments in our

systems, data centers, corporate facilities, information technology infrastructure, and employees in 2012 and

thereafter. However, the amount of our capital expenditures has fluctuated and may continue to fluctuate on a

quarterly basis.

In addition, we expect to spend a significant amount of cash on acquisitions and other investments from time

to time. These acquisitions generally enhance the breadth and depth of our expertise in engineering and other

functional areas, our technologies, and our product offerings.

Cash provided by financing activities in 2011 of $807 million was primarily driven by net proceeds of $726

million of debt issued and excess tax benefits from stock-based award activities of $86 million.

Cash provided by financing activities in 2010 of $3,050 million was primarily driven by $3,463 million of net

cash proceeds from the issuance of commercial paper and a promissory note. This was partially offset by $801

million in stock repurchases in connection with our acquisitions of AdMob and On2 Technologies, Inc., as well as

net proceeds from stock-based award activities of $294 million, and excess tax benefits from stock-based award

activities of $94 million.

Cash provided by financing activities in 2009 of $233 million was primarily due to net proceeds related to

stock-based award activities of $143 million. In addition, there were excess tax benefits of $90 million from stock-

based award activities during the period which represented a portion of the $260 million reduction to income taxes

payable that we recorded in 2009 related to the total direct tax benefit realized from the exercise, sale, or vesting

of these awards.

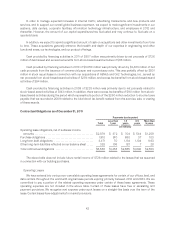

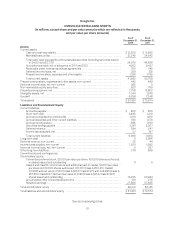

Contractual Obligations as of December 31, 2011

Payments due by period

Total Less than

1 year 1-3

years 3-5

years More than

5 years

(in millions)

Operating lease obligations, net of sublease income

amounts ............................................. $2,879 $ 372 $ 704 $ 544 $ 1,259

Purchase obligations .................................... 1,910 910 860 37 103

Long-term debt obligations .............................. 3,471 70 1,134 1,104 1,163

Other long-term liabilities reflected on our balance sheet ..... 328 106 187 7 28

Total contractual obligations ............................. $8,588 $1,458 $2,885 $1,692 $2,553

The above table does not include future rental income of $726 million related to the leases that we assumed

in connection with our building purchases.

Operating Leases

We have entered into various non-cancelable operating lease agreements for certain of our offices, land, and

data centers throughout the world with original lease periods expiring primarily between 2012 and 2063. We are

committed to pay a portion of the related operating expenses under certain of these lease agreements. These

operating expenses are not included in the above table. Certain of these leases have free or escalating rent

payment provisions. We recognize rent expense under such leases on a straight-line basis over the term of the

lease. Certain leases have adjustments for market provisions.

42