Google 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the reason for the decline in value, the potential recovery period, and our intent to sell, or whether it is more likely

than not that we will be required to sell, the investment before recovery. If any impairment is considered other-

than-temporary, we will write down the asset to its fair value and take a corresponding charge to our Consolidated

Statements of Income.

Recent Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board (FASB) issued an amendment to an existing

accounting standard which requires companies to present net income and other comprehensive income in one

continuous statement or in two separate, but consecutive, statements. In addition, in December 2011, the FASB

issued an amendment to an existing accounting standard which defers the requirement to present components of

reclassifications of other comprehensive income on the face of the income statement. We adopted both standards

in the fourth quarter of 2011.

In September 2011, the FASB issued an amendment to an existing accounting standard, which provides

entities an option to perform a qualitative assessment to determine whether further impairment testing on goodwill

is necessary. Specifically, an entity has the option to first assess qualitative factors to determine whether it

is necessary to perform the current two-step test. If an entity believes, as a result of its qualitative assessment, that

it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, the quantitative

impairment test is required. Otherwise, no further testing is required. This standard is effective for annual and

interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. We adopted this

standard in the first quarter of 2012 and the adoption will not have a material impact on our financial statements.

In May 2011, the FASB issued a new accounting standard update, which amends the fair value measurement

guidance and includes some enhanced disclosure requirements. The most significant change in disclosures is an

expansion of the information required for Level 3 measurements based on unobservable inputs. The standard is

effective for fiscal years beginning after December 15, 2011. We adopted this standard in the first quarter of 2012

and the adoption will not have a material impact on our financial statements and disclosures.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

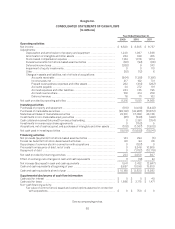

We are exposed to financial market risks, including changes in currency exchange rates and interest rates.

Foreign Currency Exchange Risk

Economic Exposure

We transact business in various foreign currencies and have significant international revenues, as well as

costs denominated in foreign currencies. This exposes us to the risk of fluctuations in foreign currency exchange

rates. We purchase foreign exchange option contracts to reduce the volatility of cash flows related to forecasted

revenues denominated in certain foreign currencies. The objective of the foreign exchange contracts is to better

ensure that the U.S. dollar-equivalent cash flows are not adversely affected by changes in the U.S. dollar/foreign

currency exchange rates. These contracts are designated as cash flow hedges. The gain on the effective portion of

a cash flow hedge is initially reported as a component of accumulated other comprehensive income (AOCI) and

subsequently reclassified into revenues when the hedged revenues are recorded or as interest and other income,

net, if the hedged transaction becomes probable of not occurring. Any gain after a hedge is de-designated or

related to an ineffective portion of a hedge is recognized as interest and other income, net, immediately.

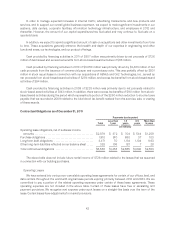

At December 31, 2010, the notional principal and fair value of foreign exchange contracts to purchase U.S.

dollars with Euros were €3.0 billion (or approximately $4.1 billion) and $227 million; the notional principal and fair

value of foreign exchange contracts to purchase U.S. dollars with British pounds were £1.5 billion (or approximately

$2.3 billion) and $97 million; and the notional principal and fair value of foreign exchange contracts to purchase

U.S. dollars with Canadian dollars were C$407 million (or approximately $382 million) and $6 million. At

45