Google 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.property, privacy, tax, labor and employment, commercial disputes, content generated by our users, goods and

services offered by advertisers or publishers using our platforms, and other matters. Such claims, suits,

government investigations, and other proceedings could result in fines, civil or criminal penalties, or other adverse

consequences.

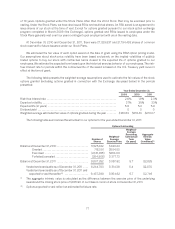

Certain of our outstanding legal matters include speculative claims for substantial or indeterminate amounts

of damages. We record a liability when we believe that it is both probable that a loss has been incurred, and the

amount can be reasonably estimated. We evaluate, on a monthly basis, developments in our legal matters that

could affect the amount of liability that has been previously accrued, and make adjustments as appropriate.

Significant judgment is required to determine both likelihood of there being and the estimated amount of a loss

related to such matters.

With respect to our outstanding legal matters, based on our current knowledge, we believe that the amount or

range of reasonably possible loss will not, either individually or in the aggregate, have a material adverse effect on

our business, consolidated financial position, results of operations, or cash flows. However, the outcome of such

legal matters is inherently unpredictable and subject to significant uncertainties.

We expense legal fees in the period in which they are incurred.

Income Taxes

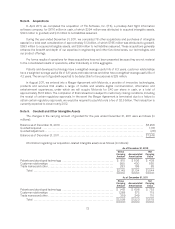

We are under audit by the Internal Revenue Service (IRS) and various other tax authorities. We have reserved

for potential adjustments to our provision for income taxes that may result from examinations by, or any

negotiated agreements with, these tax authorities, and we believe that the final outcome of these examinations or

agreements will not have a material effect on our results of operations. If events occur which indicate payment of

these amounts is unnecessary, the reversal of the liabilities would result in the recognition of tax benefits in the

period we determine the liabilities are no longer necessary. If our estimates of the federal, state, and foreign income

tax liabilities are less than the ultimate assessment, a further charge to expense would result.

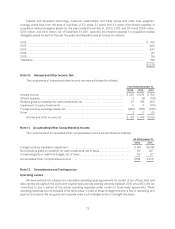

Note 13. Stockholders’ Equity

Convertible Preferred Stock

Our board of directors has authorized 100,000,000 shares of convertible preferred stock, $0.001 par value,

issuable in series. At December 31, 2010 and December 31, 2011, there were no shares issued or outstanding.

Class A and Class B Common Stock

Our board of directors has authorized two classes of common stock, Class A and Class B. At December 31,

2011, there were 6,000,000,000 and 3,000,000,000 shares authorized and there were 257,552,401 and

67,342,362 shares outstanding of Class A and Class B common stock. The rights of the holders of Class A and

Class B common stock are identical, except with respect to voting. Each share of Class A common stock is entitled

to one vote per share. Each share of Class B common stock is entitled to 10 votes per share. Shares of Class B

common stock may be converted at any time at the option of the stockholder and automatically convert upon sale

or transfer to Class A common stock. We refer to Class A and Class B common stock as common stock

throughout the notes to these financial statements, unless otherwise noted.

Stock Plans

We maintain the 1998 Stock Plan, the 2000 Stock Plan, the 2003 Stock Plan, the 2003 Stock Plan (No. 2),

the 2003 Stock Plan (No. 3), the 2004 Stock Plan, and plans assumed through acquisitions, all of which are

collectively referred to as the “Stock Plans.” Under our Stock Plans, incentive and nonqualified stock options or

rights to purchase common stock may be granted to eligible participants. Options are generally granted for a term

76