Google 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2011, our federal and state net operating loss carryforwards for income tax purposes were

approximately $420 million and $310 million. If not utilized, the federal net operating loss carryforwards will begin

to expire in 2018 and the state net operating loss carryforwards will begin to expire in 2014. The net operating loss

carryforwards are subject to various annual limitations under Section 382 of the Internal Revenue Code.

As of December 31, 2011, our California research and development credit carryforwards for income tax

purposes were approximately $55 million that can be carried over indefinitely. We believe it is more likely than not

that a portion of the state tax credit will not be realized. Therefore, we have recorded a valuation allowance on the

state tax credit carryforward in the amount of $48 million. We will reassess the valuation allowance quarterly and if

future evidence allows for a partial or full release of the valuation allowance, a tax benefit will be recorded

accordingly.

As of December 31, 2011, our federal and state capital loss carryforwards for income tax purposes were

approximately $165 million and $422 million. We also have deferred tax assets for impairment losses that, if

recognized, will be capital in nature. We believe that it is more likely than not that our deferred tax assets for capital

losses and impairment losses will not be realized. Therefore, we have recorded a valuation allowance on both our

federal and state deferred tax assets for these items in the amount of $285 million. We will reassess the valuation

allowance quarterly and if future evidence allows for a partial or full release of the valuation allowance, a tax benefit

will be recorded accordingly.

Uncertain Tax Positions

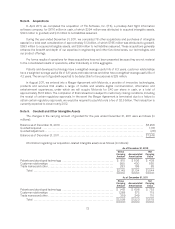

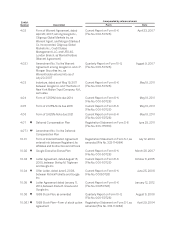

The following table summarizes the activity related to our gross unrecognized tax benefits from January 1,

2009 to December 31, 2011 (in millions):

Balance as of January 1, 2009 .................................................................. $ 721

Increases related to prior year tax positions ....................................................... 222

Decreases related to prior year tax positions ...................................................... (1)

Increases related to current year tax positions ..................................................... 246

Balance as of December 31, 2009 ............................................................... 1,188

Increases related to prior year tax positions ....................................................... 37

Decreases related to prior year tax positions ...................................................... (197)

Decreases related to settlement with tax authorities ............................................... (47)

Decreases as a result of a lapse of applicable statute of limitation .................................... (97)

Increases related to current year tax positions ..................................................... 256

Balance as of December 31, 2010 ............................................................... 1,140

Increases related to prior year tax positions ....................................................... 77

Decreases related to prior year tax positions ...................................................... (9)

Increases related to current year tax positions ..................................................... 361

Decreases related to settlement with tax authorities ............................................... (5)

Balance as of December 31, 2011 ................................................................ $1,564

Our total unrecognized tax benefits that, if recognized, would affect our effective tax rate were $814 million,

$951 million, and $1,350 million as of December 31, 2009, 2010, and 2011.

As of December 31, 2010 and 2011, we had accrued $97 million and $129 million for payment of interest and

penalties. Interest and penalties included in our provision for income taxes were not material in all the periods

presented.

We and our subsidiaries are routinely examined by various taxing authorities. Although we file U.S. federal,

U.S. state, and foreign tax returns, our two major tax jurisdictions are the U.S. and Ireland. During the three months

ended December 31, 2007, the IRS completed its examination of our 2003 and 2004 tax years. We have filed an

81