Google 2011 Annual Report Download - page 48

Download and view the complete annual report

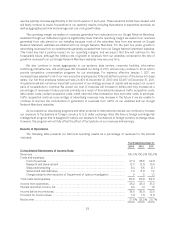

Please find page 48 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on our past results as an indication of our future performance. Our quarterly, year-to-date, and annual expenses as

a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in

future quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of the

risk factors listed in this section and the following factors may affect our operating results:

• Our ability to continue to attract users to our websites and satisfy existing users on our websites.

• Our ability to monetize (or generate revenues from) traffic on our websites and our Google Network

Members’ websites.

• Our ability to attract advertisers to our AdWords program, and our ability to attract websites to our

AdSense program.

• The mix in our revenues between those generated on our websites and those generated through our

Google Network.

• The amount of revenues and expenses generated and incurred in currencies other than U.S. dollars, and

our ability to manage the resulting risk through our foreign exchange risk management program.

• The amount and timing of operating costs and expenses and capital expenditures related to the

maintenance and expansion of our businesses, operations, and infrastructure.

• Our focus on long-term goals over short-term results.

• The results of our investments in risky projects, including new business strategies and new products,

services, and technologies.

• Our ability to keep our websites operational at a reasonable cost and without service interruptions.

• Our ability to generate significant revenues from services in which we have invested considerable time

and resources, such as Google Checkout.

Because our business is changing and evolving, our historical operating results may not be useful to you in

predicting our future operating results. In addition, advertising spending has historically been cyclical in nature,

reflecting overall economic conditions, as well as budgeting and buying patterns. Also, user traffic tends to be

seasonal. Our rapid growth has tended to mask the cyclicality and seasonality of our business. As our growth rate

has slowed, the cyclicality and seasonality in our business has become more pronounced and caused our operating

results to fluctuate.

Risks Related to Ownership of Our Common Stock

The trading price for our Class A common stock may continue to be volatile.

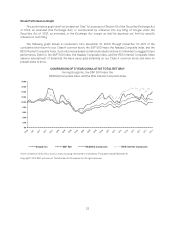

The trading price of our Class A common stock has at times experienced substantial price volatility and may

continue to be volatile. For example, in 2011, the price of our Class A common stock ranged from $473.02 per

share to $646.76 per share. The trading price of our Class A common stock may fluctuate widely in response to

various factors, some of which are beyond our control. These factors include:

• Quarterly variations in our results of operations or those of our competitors.

• Announcements by us or our competitors of acquisitions, new products, significant contracts,

commercial relationships, or capital commitments.

• Recommendations by securities analysts or changes in earnings estimates.

• Announcements about our earnings that are not in line with analyst expectations, the risk of which is

enhanced because it is our policy not to give guidance on earnings.

• Announcements by our competitors of their earnings that are not in line with analyst expectations.

19