Google 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

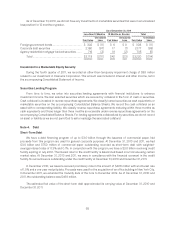

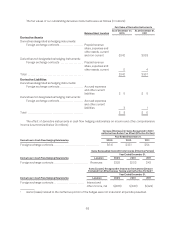

(1) This balance represents cash collateral received in connection with our securities lending program, which was

invested in reverse repurchase agreements maturing within three months.

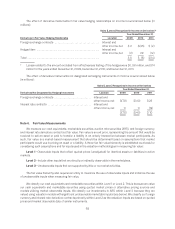

At December 31, 2011, we held $118 million of ARS. Historically, these securities have provided liquidity

through a Dutch auction process. However, these auctions began to fail in the first quarter of 2008. To estimate

their fair values at December 31, 2011, we used a discounted cash flow model based on estimated interest rates,

timing and amount of cash flows, the credit quality of the underlying securities, and illiquidity considerations.

At December 31, 2011, the estimated fair value of these ARS was $23 million below their costs. As we have no

intent to sell these ARS and it is more likely than not that we will not be required to sell these ARS prior to recovery

of our entire cost basis, we concluded the decline in the fair value was temporary and recorded the unrealized loss

to AOCI on the accompanying Consolidated Balance Sheet at December 31, 2011. To the extent we determine that

any impairment is other-than-temporary, we would record a charge to earnings. In addition, we have concluded

that the auctions for these securities may continue to fail for at least the next 12 months and as a result, we

classified them as non-current assets on the accompanying Consolidated Balance Sheet at December 31, 2011.

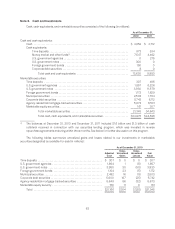

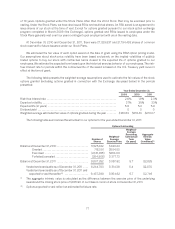

The following table presents reconciliations for our assets measured and recorded at fair value on a recurring

basis, using significant unobservable inputs (Level 3) (in millions):

Level 3

Balance at January 1, 2009 ........................................................... $197

Change in unrealized loss included in other comprehensive income ........................ 12

Net settlements ..................................................................... (27)

Balance at December 31, 2009 ........................................................ 182

Change in unrealized loss included in other comprehensive income ........................ 4

Net settlements ..................................................................... (33)

Balance at December 31, 2010 ........................................................ 153

Change in unrealized loss included in other comprehensive income ........................ (3)

Net settlements ..................................................................... (32)

Balance at December 31, 2011 ......................................................... $118

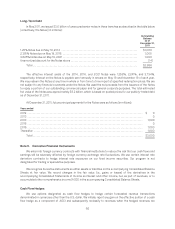

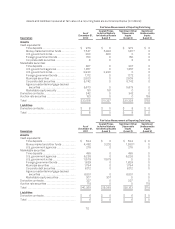

Note 7. Property and Equipment

Property and equipment consisted of the following (in millions):

As of

December 31,

2010

As of

December 31,

2011

Information technology assets ................................................ $4,670 $ 6,060

Land and buildings .......................................................... 3,969 5,228

Construction in progress ..................................................... 2,329 2,128

Leasehold improvements .................................................... 738 919

Furniture and fixtures ........................................................ 65 65

Total .................................................................. 11,771 14,400

Less: accumulated depreciation and amortization ............................... 4,012 4,797

Property and equipment, net .................................................. $7,759 $ 9,603

71