Energizer 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

74

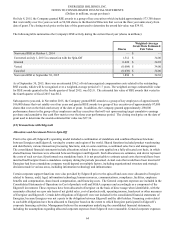

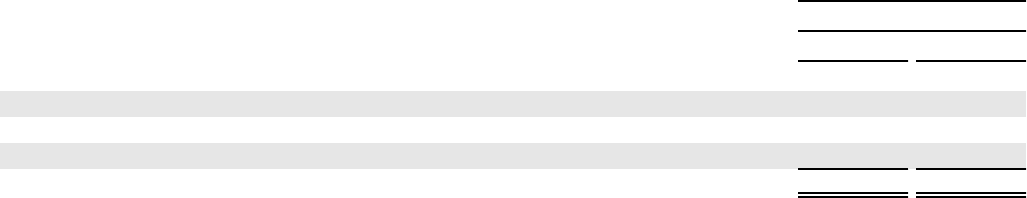

Level 2

September 30,

2015 2014

Assets/(Liabilities) at estimated fair value:

Deferred Compensation $ (58.5) $ (45.8)

Derivatives - Foreign Currency contracts 4.5 6.4

Derivatives - Interest Rate Swap (5.2) —

Total Liabilities at estimated fair value $ (59.2) $ (39.4)

Energizer had no level 1 financial assets or liabilities, other than pension plan assets, and no level 3 financial assets or liabilities

at September 30, 2015 and 2014.

Due to the nature of cash and cash equivalents, carrying amounts on the balance sheets approximate estimated fair value. The

estimated fair value of cash and cash equivalents has been determined based on level 2 inputs.

At September 30, 2015, the estimated fair value of foreign currency contracts as described above is the amount that the

Company would receive or pay to terminate the contracts, considering first, quoted market prices of comparable agreements, or

in the absence of quoted market prices, such factors as interest rates, currency exchange rates and remaining maturities. The

estimated fair value of the Company's unfunded deferred compensation liability is determined based upon the quoted market

prices of the Company's Common Stock Unit Fund as well as other investment options that are offered under the plan.

At September 30, 2015 , the fair market value of fixed rate long-term debt was $581.2 compared to its carrying value of $600.0.

The estimated fair value of the long-term debt is estimated using yields obtained from independent pricing sources for similar

types of borrowing arrangements. The estimated fair value of fixed rate long-term debt has been determined based on level 2

inputs.

(17) Environmental and Regulatory

Government Regulation and Environmental Matters – The operations of Energizer are subject to various federal, state,

foreign and local laws and regulations intended to protect the public health and the environment. These regulations relate

primarily to worker safety, air and water quality, underground fuel storage tanks and waste handling and disposal. Under the

Comprehensive Environmental Response, Compensation and Liability Act, Energizer is identified as a “potentially responsible

party” (PRP) and may be required to share in the cost of cleanup with respect to eight federal “Superfund” sites. It may also be

required to share in the cost of cleanup with respect to state-designated sites or other sites outside of the U.S.

Accrued environmental costs at September 30, 2015 were $4.2, of which $1.5 is expected to be spent during fiscal 2016. It is

difficult to quantify with certainty the cost of environmental matters, particularly remediation and future capital expenditures

for environmental control equipment. Total environmental capital expenditures and operating expenses are not expected to have

a material effect on our total capital and operating expenditures, combined earnings or competitive position. However, current

environmental spending estimates could be modified as a result of changes in our plans or our understanding of underlying

facts, changes in legal requirements, including any requirements related to global climate change, or other factors.

Legal Proceedings – The Company and its affiliates are subject to a number of legal proceedings in various jurisdictions arising

out of its operations. Many of these legal matters are in preliminary stages and involve complex issues of law and fact, and may

proceed for protracted periods of time. The amount of liability, if any, from these proceedings cannot be determined with

certainty. We are a party to legal proceedings and claims that arise during the ordinary course of business. We review our legal

proceedings and claims, regulatory reviews and inspections and other legal proceedings on an ongoing basis and follow

appropriate accounting guidance when making accrual and disclosure decisions. We establish accruals for those contingencies

where the incurrence of a loss is probable and we can be reasonably estimated, and we disclose the amount accrued and the

amount of a reasonably possible loss in excess of the amount accrued, if such disclosure is necessary for our financial

statements to not be misleading. We do not record liabilities when the likelihood that the liability has been incurred is probably,

but the amount cannot be reasonably estimated. Based upon present information, the Company believes that its liability, if any,

arising from such pending legal proceedings, asserted legal claims and known potential legal claims which are likely to be