Energizer 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

55

Estimated Fair Values of Financial Instruments – Certain financial instruments are required to be recorded at the estimated

fair value. Changes in assumptions or estimation methods could affect the fair value estimates; however, we do not believe any

such changes would have a material impact on our financial condition, results of operations or cash flows. Other financial

instruments including cash and cash equivalents and short-term borrowings, including notes payable, are recorded at cost,

which approximates estimated fair value.

Reclassifications - Certain reclassifications have been made to the prior year financial statements to conform to the current

presentation.

Recently Issued Accounting Pronouncements – On April 7, 2015, the Financial Accounting Standards Board ("FASB") issued

a new Accounting Standards Update ("ASU"), which requires debt issuance costs related to a recognized debt liability be

presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt

discounts. The update will be effective for Energizer beginning October 1, 2016, and early adoption is permitted for financial

statements that have not been previously issued. Retrospective application is required, and an entity is required to comply with

the applicable disclosures for a change in accounting principles upon adoption. Energizer expects that this guidance will be

immaterial to our financial statements.

On April 15, 2015, the FASB issued a new ASU, which provides criteria to review cloud computing arrangements to determine

whether the arrangement contains a software licenses or is solely a service contract. If the arrangement is determined to be a

software license, fees paid to the vendor would be within the scope of internal-use software guidance. If not, the fees paid

would be expensed as incurred. The update will be effective for Energizer beginning October 1, 2016. Energizer is in the

process of evaluating the impact this guidance will have on its future operations.

On May 1, 2015, the FASB issued a new ASU which permits a reporting entity to measure the fair value of certain investments

using the net asset value per share (NAV) of the investment as a practical expedient. This amendment removes the requirement

to categorize investments for which fair values are measured using the NAV in the fair value hierarchy. This update will be

effective for Energizer beginning October 1, 2016. As a result of this ASU, Energizer's pension plan assets that are valued

using their NAV will no longer be disclosed in the fair value hierarchy disclosures of ASC 820, Fair Value Measurements.

On July 22, 2015, the FASB issued a new ASU, which aligns the measurement of inventory under GAAP more closely with

International Financial Reporting Standards. Under the new guidance, an entity that measures inventory using the first-in, first-

out or average cost should measure inventory at the lower of cost and net realizable value. Net realizable value is the estimated

selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal and transportation.

The update will be effective for Energizer beginning October 1, 2017, with early adoption permitted. Energizer is in the process

of evaluating the impact the revised guidance will have on its financial statements.

On May 28, 2014, the FASB issued a new ASU which provides a single comprehensive revenue recognition model for all

contracts with customers to improve comparability within industries, across industries and across capital markets. On August

12, 2015, the FASB issued a one-year deferral of the effective date of the ASU. The update will now be effective for Energizer

beginning October 1, 2018. Energizer is in the process of evaluating the impact the revised guidance will have on its financial

statements.

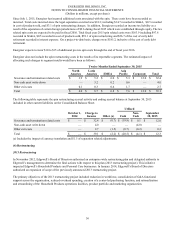

(3) Spin Costs

Prior to the spin on July 1, 2015, Edgewell incurred costs to evaluate, plan and execute the spin transaction, and Energizer was

allocated a pro rata portion of those costs. Edgewell’s total spin costs through the close of the separation were $358 on a pre-tax

basis. Through the close of the separation, Energizer's allocation of these spin costs were approximately $167.0 on a pre-tax

basis; including $104.2 recorded in SG&A, $36.0 of spin restructuring charges and $26.7 of cost associated with early debt

retirement recorded in interest expense. The allocated amounts in SG&A included $82.9 and $21.3 recorded in fiscal 2015 and

2014, respectively. The spin restructuring and cost of early debt retirement were recorded fully in fiscal 2015.

Prior to separation, Energizer and Edgewell entered into Transition Services Agreement (TSA). Under the TSA, the Companies

agreed to share the costs associated with the spin incurred subsequent to the separation. Based on the agreement, Energizer is

responsible for 40% of such costs incurred subsequent to the separation. See further discussion in Note 12, Transactions with

Edgewell.