Energizer 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

63

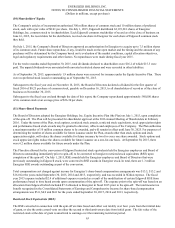

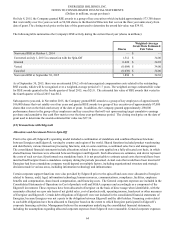

(10) Shareholders' Equity

The Company's articles of incorporation authorized 300 million shares of common stock and 10 million shares of preferred

stock, each with a par value of $0.01 per share. On July 1, 2015, Edgewell distributed 62,193,281 shares of Energizer

Holdings, Inc. common stock to its shareholders. Each Edgewell common stockholder of record as of the close of business on

June 16, 2015, the record date for the distribution, received one share in Energizer for each share of Edgewell common stock

they held.

On July 1, 2015, the Company's Board of Directors approved an authorization for Energizer to acquire up to 7.5 million shares

of its common stock. Future share repurchase, if any, would be made on the open market and the timing and the amount of any

purchases will be determined by the Company based on its evaluation of the market conditions, capital allocation objectives,

legal and regulatory requirements and other factors. No repurchases were made during fiscal year 2015.

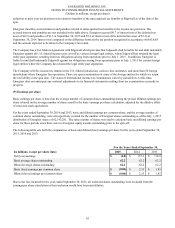

For the twelve months ended September 30, 2015, total dividends declared to shareholders were $16.2 of which $15.5 were

paid. The unpaid dividends were associated with unvested restricted shares and were recorded in other liabilities.

As of September 30, 2015, approximately 1.9 million shares were reserved for issuance under the Equity Incentive Plan. There

were no preferred stock issued or outstanding as of September 30, 2015.

Subsequent to the fiscal year end, on November 16, 2015, the Board of Directors declared a dividend for the first quarter of

fiscal 2016 of $0.25 per share of common stock, payable on December 16, 2015, to all shareholders of record as of the close of

business on November 30, 2015.

Subsequent to the fiscal year end and through the date of this report, the Company repurchased approximately 580,000 shares

of its common stock at an average price of $36.30 per share.

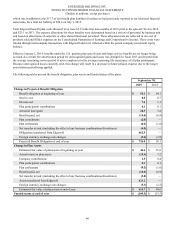

(11) Share-Based Payments

The Board of Directors adopted the Energizer Holdings, Inc. Equity Incentive Plan (the Plan) on July 1, 2015, upon completion

of the spin-off. The Plan will be presented for shareholder approval at the 2016 Annual Meeting of Shareholders in February

2016. Under the terms of the Plan, stock options, restricted stock awards, restricted stock equivalents, stock appreciation rights

and performance-based stock awards may be granted to directors, officers and employees of the Company. The Plan authorizes

a maximum number of 10 million common shares to be awarded, and will remain in effect until June 30, 2025. For purposes of

determining the number of shares available for future issuance under the Plan, awards other than stock options and stock

appreciation rights, will reduce the shares available for future issuance by two for every one share awarded. Stock options and

stock appreciate rights reduce the shares available for future issuance on a one-for-one basis. At September 30, 2015, there

were 6.2 million shares available for future awards under the Plan.

The Plan also allowed for the conversion of Edgewell restricted stock equivalents held by Energizer employees and Board of

Directors outstanding immediately prior to spin-off, to be converted to Energizer restricted stock equivalents (RSE) upon

completion of the spin-off. On July 1, 2015, RSE awards held by Energizer employees and Board of Directors that were

previously outstanding in Edgewell stock, were converted to RSE awards in Energizer stock. In total, there are 1.3 million

Energizer RSE awards outstanding as part of the conversion.

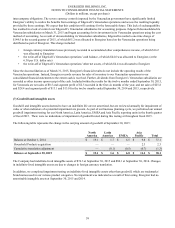

Total compensation cost charged against income for Energizer’s share-based compensation arrangements was $13.5, $13.2 and

$16.0 for the years ended September 30, 2015, 2014 and 2013, respectively, and was recorded in SG&A expense. The fiscal

year 2015 expense included $2.4 of additional expense recorded as a result of the modification of certain Edgewell RSE from

performance based to time based awards upon consummation of the spin-off. The expense prior to the spin-off was based on an

allocation from Edgewell which included $7.2 allocated to Energizer in fiscal 2015 prior to the spin-off. The total income tax

benefit recognized in the Consolidated Statements of Earnings and Comprehensive Income for share-based compensation

arrangements was $5.0, $4.9 and $6.0 for the years ended September 30, 2015, 2014 and 2013, respectively.

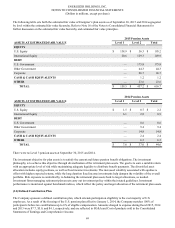

Restricted Stock Equivalents (RSE)

The RSE converted in connection with the spin-off are time based and either vest ratably over four years from their initial date

of grant, or else the entire award vests on either the second or third anniversary date from initial grant. The fair value of the

restricted stock at the date of grant is amortized to earnings over the remaining restriction period.