Energizer 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

62

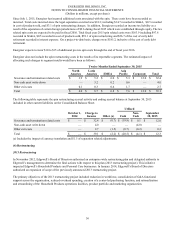

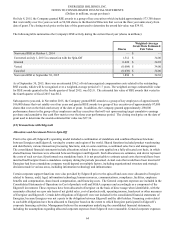

reduction to prior year tax positions was related to transfers of the unrecognized tax benefits to Edgewell as of the date of the

spin.

Energizer classifies accrued interest and penalties related to unrecognized tax benefits in the income tax provision. The

accrued interest and penalties are not included in the table above. Energizer accrued $0.7 of interest (net of the deferred tax

asset of $0.2) and penalties of $1.3 at September 30, 2015 and $3.6 of interest (net of the deferred tax asset of $1.3) at

September 30, 2014. Interest was computed on the difference between the tax position recognized in accordance with GAAP

and the amount expected to be taken in the Company's tax return.

The Company has a Tax Matters Agreement with Edgewell which provides that Edgewell shall be liable for and shall indemnify

Energizer against all U.S. federal income taxes as well as various foreign legal entities, where Edgewell has retained the legal

entity past separation, resulting from tax obligations arising from operations prior to July 1, 2015. In addition, Energizer is

liable for and shall indemnify Edgewell against tax obligations arising from operations prior to July 1, 2015 for certain foreign

legal entities where the Company has retained the legal entity past separation.

The Company will file income tax returns in the U.S. federal jurisdiction, various cities and states, and more than 50 foreign

jurisdictions where Energizer has operations. There are open examinations at some of the foreign entities for which we retain

the tax liability at the spin date. The status of international income tax examinations varies by jurisdiction. At this time,

Energizer does not anticipate any material adjustments to its financial statements resulting from tax examinations currently in

progress.

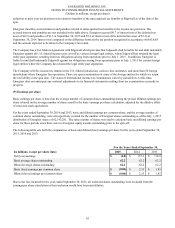

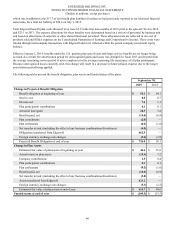

(9) Earnings per share

Basic earnings per share is based on the average number of common shares outstanding during the period. Diluted earnings per

share is based on the average number of shares used for the basic earnings per share calculation, adjusted for the dilutive effect

of restricted stock equivalents.

For the years ended September 30, 2014 and 2013, basic and diluted earnings per common share, and the average number of

common shares outstanding, were retrospectively restated for the number of Energizer shares outstanding as of the July 1, 2015

distribution of Energizer shares of 62,193,281. The same number of shares was used to calculate basic and diluted earnings per

share for these periods since there were no Energizer equity awards outstanding prior to the spin-off.

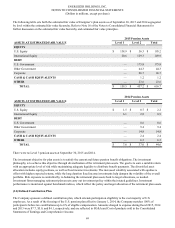

The following table sets forth the computation of basic and diluted (loss)/earnings per share for the years ended September 30,

2015, 2014 and 2013:

For the Years Ended September 30,

(in millions, except per share data) 2015 2014 2013

Net (loss)/earnings $(4.0)$ 157.3 $ 114.9

Basic average shares outstanding 62.2 62.2 62.2

Diluted average shares outstanding 62.2 62.2 62.2

Basic (loss)/earnings per common share $(0.06)$ 2.53 $ 1.85

Diluted (loss)/earnings per common share $(0.06)$ 2.53 $ 1.85

Due to the loss incurred for the year ended September 30, 2015, all restricted shares outstanding were excluded from the

earnings per share calculation as their inclusion would have been anti-dilutive.