Energizer 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and

uncertainties include those described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in this Report, as updated from time to time in the Company’s public filings.

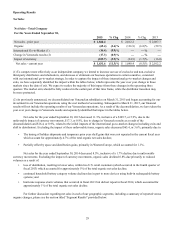

Non-GAAP Financial Measures

While the Company reports financial results in accordance with accounting principles generally accepted in the

U.S. (“GAAP”), this discussion includes non-GAAP measures. These non-GAAP measures, such as adjusted net earnings,

adjusted net earnings per diluted share, operating results, organic net sales, gross margin, SG&A as a percent of net sales

(exclusive of spin costs, restructuring related charges and integration expenses), advertising and promotional expense as a

percent of net sales and other comparison changes, the costs associated with restructuring and other initiatives, costs

associated with the spin-off transaction, cost of early debt retirement, certain charges related to the Venezuela

deconsolidation, changes to our international go to market strategy, costs associated with acquisition integration,

adjustments to prior year tax accruals and certain other items as outlined in this announcement, are not in accordance with,

nor are they a substitute for GAAP measures. Additionally, we are unable to provide a reconciliation of forward-looking

non-GAAP measures due to uncertainty regarding future restructuring related charges, spin-off related charges, the impact

of fluctuations in foreign currency movements and the cost of raw materials. The Company believes these non-GAAP

measures provide a meaningful comparison to the corresponding historical or future period and assist investors in

performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP

measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures.

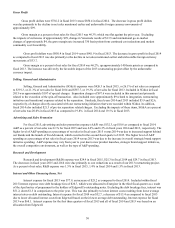

The Separation

On July 1, 2015, Edgewell Personal Care Company completed the previously announced separation of its business

(the spin-off or spin) into two separate independent public companies, Energizer Holdings, Inc. (Energizer or the

Company) and Edgewell Personal Care Company (Edgewell). To effect the separation, Edgewell undertook a series of

transactions to separate net assets and legal entities. As a result of these transactions, Energizer now holds the Household

Products’ product group and Edgewell holds the Personal Care product group. As a result of the Spin-Off, Energizer now

operates as an independent, publicly traded company on the New York Stock Exchange trading under the symbol "ENR."

In conjunction with the spin-off, on July 1, 2015, Edgewell distributed 62,193,281 shares of Energizer Holdings,

Inc. common stock to Edgewell shareholders. Under the terms of the spin-off of the Household Products business,

Edgewell common stockholders of record as of the close of business on June 16, 2015, the record date for the distribution,

received one share in Energizer Holdings, Inc., for each share of Edgewell common stock they held. Edgewell completed

the distribution of Energizer common stock to its shareholders on July 1, 2015, the distribution date. Edgewell structured

the distribution to be tax-free to its U.S. shareholders for U.S. federal income tax purposes.

Energizer's first three fiscal quarters of 2015 as well as all of 2014 and 2013 are based on carve out financial

data. Net sales, Gross profit, Advertising & promotion (A&P) and Research & development (R&D) spending are directly

attributable to our business. However, certain Selling, general, and administrative expense (SG&A), Interest expense and

Spin-off and Restructuring related charges are allocated from Edgewell and not necessarily representative of Energizer's

stand-alone results or expected future results of Energizer as an independent company. Energizer's fourth fiscal quarter

2015 was our first quarter with stand-alone financial data.

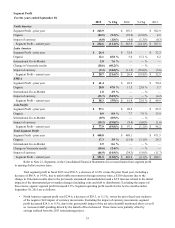

Overview

General

Energizer, through its worldwide operating subsidiaries, is one of the world’s largest manufacturers and

marketers of primary batteries and lighting products. Energizer manufactures, markets and/or licenses one of the most

extensive product portfolios of household batteries, specialty batteries and portable lights. Energizer is the beneficiary of

over 100 years of expertise in the battery and portable lighting products industries. Its brand names, Energizer and

Eveready, have worldwide recognition for innovation, quality and dependability, and are marketed and sold around the

world.