Energizer 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

64

On July 8, 2015, the Company granted RSE awards to a group of key executives which included approximately 573,700 shares

that vest ratably over five years as well as 50,300 shares to the Board of Directors that vest on the three year anniversary from

date of grant. The closing stock price on the date of the grant used to determine the award fair value was $34.92.

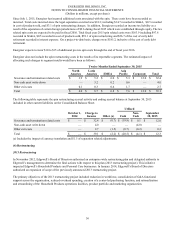

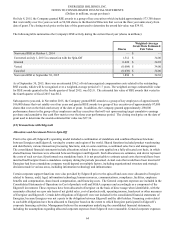

The following table summarizes the Company's RSE activity during the current fiscal year (shares in millions):

Shares

Weighted-Average

Grant Date Estimated

Fair Value

Nonvested RSE at October 1, 2014 — $ —

Converted on July 1, 2015 in connection with the Spin-Off 1.312 $ 34.00

Granted 0.624 $ 34.92

Vested (0.004) $ 34.00

Canceled (0.038) $ 34.00

Nonvested RSE at September 30, 2015 1.894 $ 34.30

As of September 30, 2015, there was an estimated $36.2 of total unrecognized compensation costs related to the outstanding

RSE awards, which will be recognized over a weighted-average period of 1.7 years. The weighted average estimated fair value

for RSE awards granted in the fourth quarter of fiscal 2015, was $21.8. The estimated fair value of RSE awards that vested in

the fourth quarter of fiscal 2015 was $0.2.

Subsequent to year-end, in November 2015, the Company granted RSE awards to a group of key employees of approximately

106,000 shares that vest ratably over four years and granted RSE awards to a group of key executives of approximately 87,000

shares that vest on the third anniversary of the date of grant. In addition, the Company granted approximately 290,000

performance shares to the group of key employees and key executives that will vest upon meeting target cumulative earnings

per share and cumulative free cash flow metrics over the three year performance period. The closing stock price on the date of

grant used to determine the awards estimated fair value was $37.34.

(12) Transactions with Edgewell

Allocations and Investment Prior to Spin-Off

Prior to the spin-off, Edgewell’s operating model included a combination of standalone and combined business functions

between Energizer and Edgewell, varying by country and region of the world. Shared functions included product warehousing

and distribution, various transaction processing functions, and, in some countries, a combined sales force and management.

The consolidated financial statements include allocations related to these costs applied on a fully allocated cost basis, in which

shared business functions were allocated between Energizer and Edgewell. Such allocations are estimates, and do not represent

the costs of such services if performed on a standalone basis. It is not practicable to estimate actual costs that would have been

incurred had Energizer been a standalone company during the periods presented. Actual costs that would have been incurred if

Energizer had been a standalone company would depend on multiple factors, including organizational structure and strategic

decisions made in various areas, including information technology and infrastructure.

Certain corporate support functions were also provided by Edgewell prior to the spin-off and costs were allocated to Energizer

related to finance, audit, legal, information technology, human resources, communications, compliance, facilities, employee

benefits and compensation, share-based compensation, and financing costs. The General corporate expenses are included in the

Consolidated Statements of Operations in Cost of products sold and SG&A expenses and accordingly as a component of the

Edgewell investment. These expenses have been allocated to Energizer on the basis of direct usage when identifiable, with the

remainder allocated on a pro rata basis of net global sales, cost of products sold, operating income, headcount or other measures

of Energizer and Edgewell. Certain debt obligations of Edgewell were not included in the consolidated financial statements of

Energizer, because Energizer was not a party to the obligation between Edgewell and the debt holders. Financing costs related

to such debt obligations have been allocated to Energizer based on the extent to which Energizer participated in Edgewell’s

corporate financing activities. Management believes the assumptions underlying the consolidated financial statements,

including the assumptions regarding allocated corporate expenses from Edgewell were reasonable. General corporate expenses