Energizer 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

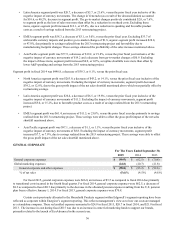

cannot be reasonably estimated. Based upon present information, the Company believes that its liability, if any, arising from

such pending legal proceedings, asserted legal claims and known potential legal claims which are likely to be asserted, is not

reasonably likely to be material to the Company's financial position, results of operations, or cash flows, when taking into

account established accruals for estimated liabilities.

Critical Accounting Policies

The methods, estimates, and judgments Energizer uses in applying its most critical accounting policies have a significant

impact on the results the Company reports in its Consolidated Financial Statements. Specific areas, among others, requiring the

application of management’s estimates and judgment include assumptions pertaining to allocations from Edgewell for pre-spin

periods, accruals for consumer and trade-promotion programs, pension benefit costs, share-based compensation, uncertain tax

positions, the reinvestment of undistributed foreign earnings and tax valuation allowances. On an ongoing basis, Energizer

evaluates its estimates, but actual results could differ materially from those estimates.

The Company's critical accounting policies have been reviewed with the Audit Committee of the Board of Directors. A

summary of Energizer’s significant accounting policies is contained in Note 2, Summary of Significant Accounting Policies, of

the Notes to the Consolidated Financial Statements. This listing is not intended to be a comprehensive list of all of Energizer’s

accounting policies.

• Basis of Presentation - The consolidated financial statements include the accounts of Energizer and its subsidiaries.

All significant intercompany transactions are eliminated. Energizer has no material equity method investments or

variable interests.

Prior to the spin-off on July 1, 2015, our financial statements were prepared on a combined standalone basis derived

from the financial statements and accounting records of Edgewell and reflect the historical results of operations,

financial position and cash flows of Energizer in accordance with GAAP. Account allocations of shared functions to

Energizer were based on the allocations to the Household Products segment within Edgewell's financial statements.

Shared functions between Edgewell's Household Products and Personal Care segments and Edgewell itself include

product warehousing and distribution, various transaction processing functions, and in some countries, a combined

sales force and management. Edgewell has historically applied a fully allocated cost basis, in which shared business

functions are allocated between the segments. Such allocations by Edgewell are estimates, and do not fully represent

the costs of such services if performed on a standalone basis.

The Financial Statements are presented as if Energizer had been carved out of Edgewell for all periods prior to the

spin-off. All significant transactions within Energizer were eliminated. The assets and liabilities in the carve-out

financial statements have been reflected on a historical cost basis, as immediately prior to the distribution all of the

assets and liabilities presented are wholly owned by ParentCo and were being transferred to Energizer at carry-over

basis.

• Corporate Expense Allocations - These Consolidated Financial Statements include expense allocations for the

periods prior to the spin-off including (1) certain product warehousing and distribution; (2) various transaction process

functions; (3) a consolidated sales force and management for certain countries; (4) certain support functions that are

provided on a centralized basis within Edgewell and not recorded at the business division level, including, but not

limited to, finance, audit, legal, information technology, human resources, communications, facilities, and compliance;

(5) employee benefits and compensation; (6) share-based compensation; (7) financing costs; (8) the effects of

restructurings and the Venezuela deconsolidation; and (9) cost of early debt retirement. These expenses were allocated

to Energizer on the basis of direct usage where identifiable, with the remainder allocated on a basis of global net sales,

cost of sales, operating income, headcount or other measures of Energizer and Edgewell. Certain debt obligations of

Edgewell have not been included in the Consolidated Financial Statements of Energizer prior to the spin-off, because

Energizer was not a party to the obligation between Edgewell and the debt holders. Financing costs related to such

debt obligations have been allocated to Energizer based on the extent to which Energizer participated in Edgewell's

corporate financing activities. For an additional discussion of expense allocations, see Note 12, Transactions with

Edgewell, to the Consolidated Financial Statements.

Management believes the assumptions regarding allocated expenses, reasonably reflect the utilization of services

provided to or the benefit received by Energizer during the periods prior to the spin-off. Nevertheless, the allocations

may not include all of the actual expenses that would have been incurred by Energizer and may not reflect our results

of operations, financial position and cash flows had we been an independent standalone company. It is not practicable

to estimate actual costs that would have been incurred had Energizer been a standalone company during the periods