Energizer 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

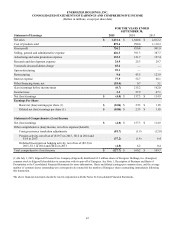

38

Investing Activities

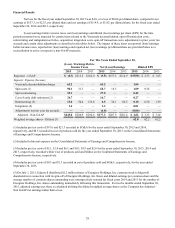

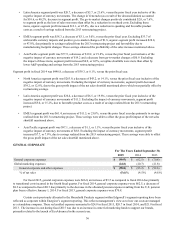

Net cash used by investing activities was $38.8, $22.8, and $16.8 in fiscal years 2015, 2014 and 2013, respectively.

The primary driver of the change in net cash used by investing activities versus the prior years was due to the timing of capital

expenditures as there was less activity during the time of our 2013 restructuring program. Capital expenditures were $40.4,

$28.4, and $17.8 in fiscal years 2015, 2014 and 2013, respectively. The ramp up in capital expenditures in fiscal 2015 was

primarily due to IT spending associated with the separation. These capital expenditures were funded by cash flow from

operations. See Note 21, Segments, of the Notes to Consolidated Financial Statements for capital expenditures by segment.

Investing cash outflows of approximately $35 to $45 are anticipated in fiscal 2016 with a large percentage of the

disbursements for capital expenditures relating to maintenance, product development and cost reduction investments. Total

capital expenditures are expected to be financed with funds generated from operations.

Financing Activities

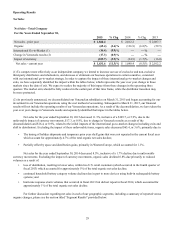

Net cash from financing activities was $309.2 in 2015 and net cash used by financing activities was $185.5 and $301.2

in fiscal years 2014 and 2013, respectively.

For fiscal 2015, cash flow from financing activities consists of the following:

• Net cash proceeds of $999.0 resulted from the June 1, 2015 debt issuance consisting of a seven-year $400.0 senior

secured term loan B facility and the June 30, 2015 issuance of $600.0 of 5.50% Senior Notes due 2025;

• Debt issuance costs of $12.1 represents the fees paid and capitalized as part of the June 1, 2015 debt issuance;

• Payments on debt with maturities greater than 90 days represents the first quarter principal payment on the Term Loan;

• Payments on debt with maturities of 90 days or less represents the pay down of notes payable;

• Dividends paid of $15.5 during the fourth fiscal quarter (see below); and

• Net transfers to Parent and affiliates represents the cash flow impact of Energizer’s net dividend to Edgewell. The

increase in the net transfers for fiscal 2015 was the result of the transfer of proceeds of the term loan and senior notes

to Edgewell in connection with the contribution of certain assets including cash by Edgewell to Energizer in

connection with the separation.

Net cash used by financing activities in fiscal 2014 and 2013 of $185.5 and $301.2 represent the cash flow impact of

Energizer’s net activity with Edgewell during those periods.

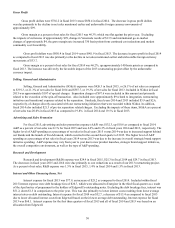

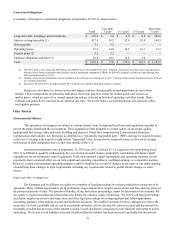

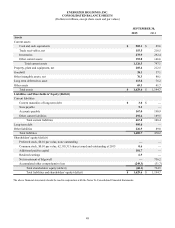

Dividends

Total dividends declared to shareholders were $16.2 of which $15.5 were paid during the fourth fiscal quarter. The

unpaid dividends were associated with unvested restricted shares and were recorded in other liabilities.

Subsequent to the fiscal year end, on November 16, 2015, the Board of Directors declared a dividend for the first

quarter of fiscal 2016 of $0.25 per share of common stock, payable on December 16, 2015, to all shareholders of record as of

the close of business on November 30, 2015.

Share Repurchases

On July 1, 2015, the Company's Board of Directors approved an authorization for Energizer to acquire up to 7.5

million shares of its common stock. Future share repurchase, if any, would be made on the open market and the timing and the

amount of any purchases will be determined by the Company based on its evaluation of the market conditions, capital

allocation objectives, legal and regulatory requirements and other factors. No share repurchases were made during fiscal year

2015; however, subsequent to the fiscal year end and through the date of this report, the Company repurchased approximately

580,000 shares of its common stock at an average price of $36.30 per share.