Energizer 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

65

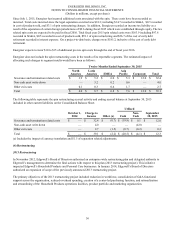

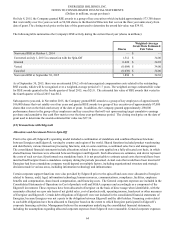

allocated to Energizer during the fiscal years ended September 30, 2015, 2014 and 2013 were $43.0, $62.5 and $70.8,

respectively.

All significant intercompany transactions between Energizer and Edgewell prior to the spin-off were included in the

consolidated financial statements and were considered to be effectively settled for cash at the time the transaction was recorded.

The total net effect of the settlement of these intercompany transactions was reflected in the Consolidated Statements of Cash

Flows as a financing activity and in the Consolidated Balance Sheets as Edgewell investment. Energizer engaged in cash

pooling arrangements with related parties that were managed centrally by Edgewell. The amount owed by Energizer into this

arrangement was $86.2 at September 30, 2014.

Post Spin-Off Activity

In connection with the spin-off, the Company entered into a series of agreements with Edgewell which are intended to govern

the relationship between the Company and Edgewell and to facilitate an orderly separation of Energizer from Edgewell. These

agreements include a Separation and Distribution Agreement (Separation Agreement), Transition Services Agreement (TSA),

Employee Matters Agreement, and Tax Matters Agreement.

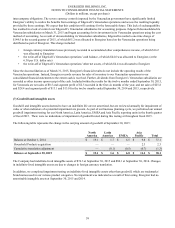

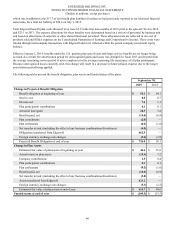

In accordance with the Separation Agreement, at the time of the spin-off, Edgewell contributed its net investment in Energizer

and certain assets and liabilities in exchange for a $1,000.0 cash distribution which was funded through the incurrence of long-

term debt by Energizer. In addition, separation related adjustments of $299.6 are included on the Consolidated Statements of

Shareholders' Equity/(Deficit) consisting of $417.7 of cash and cash equivalents transferred to Energizer from Edgewell at the

spin, offset by liabilities assumed by Energizer related to the pension plans of $41.7, income taxes payable of $42.2 and $34.2

of various other net liabilities.

The Separation Agreement included provisions on how to allocate assets and liabilities between legal entities that were being

split into a separate Edgewell and Energizer legal entity as part of the spin-off. Due to the systems restraints and foreign legal

restraints, it was not possible for all Energizer assets and liabilities to be transferred to the new legal entity as part of the spin.

The Separation Agreement provided for a mechanism to quantify and help to settle the legal assets and liabilities that remained

with Edgewell post split. The Separation Agreement also included provisions on the split of joint administrative costs that were

incurred post spin. These costs were to be allocated 60% to Edgewell and 40% to Energizer.

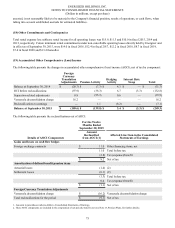

Under the TSA, Energizer and Edgewell will provide each other certain specified services on a transitional basis, including,

among others, payroll and other human resource services, information systems, insurance, legal and other corporate services, as

well as procurement and sourcing support. The charges for the transition services are generally intended to allow the providing

company to fully recover the allocated direct costs of providing the services, plus all out-of-pocket costs and expenses,

generally without profit except where required by local law. Energizer anticipates that it will generally be in a position to

complete the transition of most services on or before 24 months following the date of the spin. The expenses related to the TSA

through September 30, 2015 were immaterial.

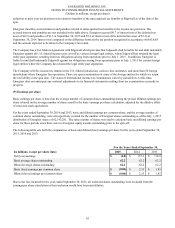

As a result of the Separation Agreement, the TSA and the various activity between Energizer and Edgewell post spin, Energizer

recorded a receivable in other current assets of $30.4 and a payable in other current liabilities of $14.0 related to transactions

with Edgewell.

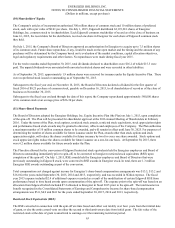

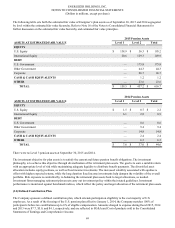

(13) Pension Plans

Certain employees participate in defined benefit pension plans sponsored by the Company.

Our Participation in Edgewell’s Pension and the Spin-Off Impact:

Prior to the spin-off, Edgewell provided defined benefit pension plans to our eligible employees and retirees. As such, we

applied the multiemployer plan accounting approach and these liabilities were not reflected in our consolidated balance sheets.

We did provide pension coverage for certain employees that were specific to our Energizer entities through separate plans and

those plans were included in our Consolidated Financial Statements prior to the spin-off.

As part of the spin-off, and in accordance with the Employee Matters Agreement, the combined plans were split and we

assumed the obligations previously provided by Edgewell. Accordingly, Edgewell transferred to us the plan assets and liabilities

associated with our active, retired, and other former employees. We assumed net benefit plan liabilities of $41.7 from Edgewell,