Energizer 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

56

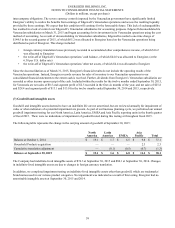

Since July 1, 2015, Energizer has incurred additional costs associated with the spin. These costs have been recorded as

incurred. Total costs incurred since the legal separation occurred was $18.3; including $14.7 recorded in SG&A, $0.5 recorded

in cost of products sold, and $3.1 of spin restructuring charges. In addition, Energizer recorded an income tax liability as a

result of the separation of certain foreign jurisdictions of $9.6 during fiscal 2015 which were established through equity. The tax

related spin costs are expected to be paid in fiscal 2016. Total fiscal year 2015 spin related costs were $163.9 including $97.6

recorded in SG&A, $0.5 recorded in cost of products sold, $39.1 of spin restructuring and $26.7 of the cost of early debt

retirement recorded in interest expense. On a project-to-date basis, charges were $185.2, inclusive of the cost of early debt

retirement.

Energizer expects to incur $10 to $15 of additional pre-tax spin costs through the end of fiscal year 2016.

Energizer does not include the spin restructuring costs in the results of its reportable segments. The estimated impact of

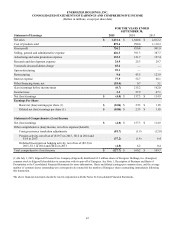

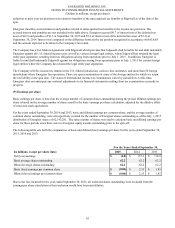

allocating such charges to segment results would have been as follows:

Twelve Months Ended September 30, 2015

North

America Latin

America EMEA Asia

Pacific Corporate Total

Severance and termination related costs $ 3.9 $ 5.2 $ 6.0 $ 5.3 $ 12.0 $ 32.4

Non-cash asset write-down — 3.2 0.2 0.6 — 4.0

Other exit costs 0.1 0.3 0.6 1.7 — 2.7

Total $ 4.0 $ 8.7 $ 6.8 $ 7.6 $ 12.0 $ 39.1

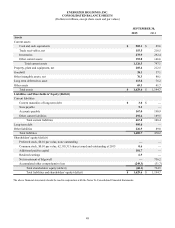

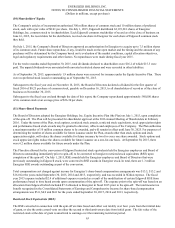

The following table represents the spin restructuring accrual activity and ending accrual balance at September 30, 2015

included in other current liabilities on the Consolidated Balance Sheet.

Utilized

October 1,

2014 Charge to

Income Other (a) Cash Non-

Cash September

30, 2015

Severance and termination related costs $ — $ 32.4 $ (0.7) $ (19.8) $ 0.1 $ 12.0

Non-cash asset write down — 4.0 — — (4.0) —

Other exit costs — 2.7 (1.5)(0.7)(0.2) 0.3

Total $ — $ 39.1 $ (2.2) $ (20.5) $ (4.1) $ 12.3

(a) Includes the impact of currency translation and $1.5 of separation related adjustments.

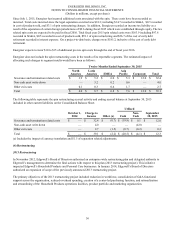

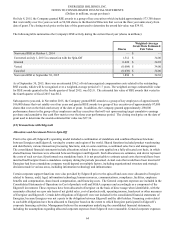

(4) Restructuring

2013 Restructuring

In November 2012, Edgewell’s Board of Directors authorized an enterprise-wide restructuring plan and delegated authority to

Edgewell’s management to determine the final actions with respect to this plan (2013 restructuring project). This initiative

impacted Edgewell’s Household Products and Personal Care businesses. In January 2014, Edgewell’s Board of Directors

authorized an expansion of scope of the previously announced 2013 restructuring project.

The primary objectives of the 2013 restructuring project included reduction in workforce, consolidation of G&A functional

support across the organization, reduced overhead spending, creation of a center-led purchasing function, and rationalization

and streamlining of the Household Products operations facilities, product portfolio and marketing organization.