Energizer 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

66

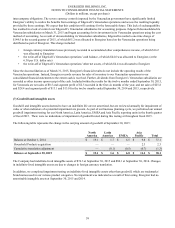

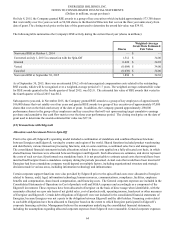

which was in addition to the $17.7 of net benefit plan liabilities for plans we had previously reported in our historical financial

statements, for a total net liability of $59.4 on July 1, 2015.

Total Edgewell benefit plan costs allocated to us were $5.9 in the first nine months of 2015 prior to the spin-off, $6.4 in 2014,

and $23.1 in 2013. The expense allocations for these benefits were determined based on a review of personnel by business unit

and based on allocations of corporate or other shared functional personnel. These allocated costs are reflected in our cost of

products sold and SG&A expenses on the Consolidated Statements of Earnings and Comprehensive Income. These costs were

funded through intercompany transactions with Edgewell and were reflected within the parent company investment equity

balance.

Effective January 1, 2014, benefits under the U.S. pension plan were frozen and future service benefits are no longer being

accrued. As a result, the amortization period for unrecognized gains and losses was changed for fiscal 2015 and beyond from

the average remaining service period of active employees to the average remaining life expectancy of all plan participants.

Because unrecognized losses currently exist, this change will result in a decrease in future pension expense due to the longer

amortization period being applied.

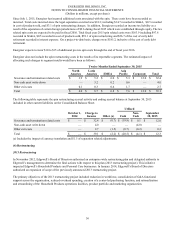

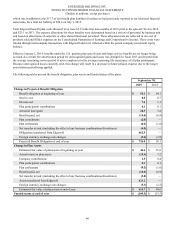

The following tables present the benefit obligation, plan assets and funded status of the plans:

September 30,

2015 2014

Change in Projected Benefit Obligation

Benefit obligation at beginning of year $ 58.1 $ 64.1

Service cost 0.8 0.7

Interest cost 7.6 1.3

Plan participants' contributions 0.1 0.1

Actuarial loss/(gain) 24.3 3.4

Benefits paid, net (16.0)(6.9)

Plan curtailments (2.0)—

Plan settlements (0.2)(1.6)

Net transfer in/(out) (including the effect of any business combinations/divestitures) (4.0)—

Obligations transferred from Edgewell 662.9 —

Foreign currency exchange rate changes (5.6)(3.0)

Projected Benefit Obligation at end of year $ 726.0 $ 58.1

Change in Plan Assets

Estimated fair value of plan assets at beginning of year $ 44.6 $ 51.6

Actual return on plan assets (25.4)3.2

Company contributions 1.5 0.4

Plan participants' contributions 0.1 0.1

Plan settlements (0.2)(1.6)

Benefits paid, net (16.0)(6.9)

Net transfer in/(out) (including the effect of any business combinations/divestitures) (3.8)—

Assets transferred from Edgewell 621.2 —

Foreign currency exchange rate changes (5.3)(2.2)

Estimated fair value of plan assets at end of year $ 616.7 $ 44.6

Funded status at end of year $ (109.3)$(13.5)