Energizer 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

70

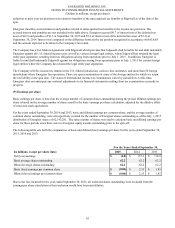

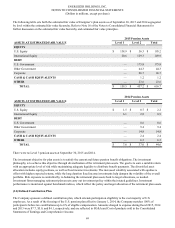

(15) Debt

The detail of long-term debt was as follows:

September 30,

2015 September 30,

2014

Senior Secured Term Loan B Facility, net of discount, due 2022 $ 398.0 $ —

5.50% Senior Notes due 2025 600.0 —

Total long-term debt, including current maturities 998.0 —

Less current portion 3.0 —

Total long-term debt $ 995.0 $ —

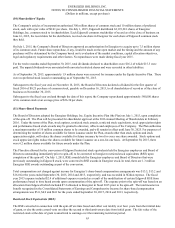

On June 1, 2015, the Company entered into a credit agreement which provides for a five-year $250.0 senior secured revolving

credit facility (Revolving Facility) and a seven-year $400.0 senior secured term loan B facility (Term Loan) that became

effective on June 30, 2015. Also on June 1, 2015, Energizer completed the issuance and sale of $600.0 of 5.50% Senior Notes

due 2025 (Senior Notes), with proceeds placed in escrow and released June 30, 2015.

Borrowings under the Revolving Facility will bear interest at LIBOR plus the applicable margin based on total Company

leverage. As of September 30, 2015, the Company did not have outstanding borrowings under the Revolving Facility and had

$6.4 of outstanding letters of credit. Taking into account outstanding letters of credit, $243.6 remains available as of September

30, 2015.

The $400.0 Term Loan was issued at a $1.0 discount and bears interest at LIBOR plus 250 basis points subject to a 75 basis

point floor. The loans and commitments under the Term Loan require quarterly principal payments at a rate of 0.25% of the

original principal balance. Obligations under the Revolving Facility and Term Loan are jointly and severally guaranteed by

certain of its existing and future direct and indirectly wholly-owned U.S. subsidiaries. There is a first priority perfected lien on

substantially all of the assets and property of Energizer and guarantors and proceeds therefrom excluding certain excluded

assets. In August 2015, the Company entered into an interest rate swap agreement with one major financial institution that

fixed the variable benchmark component (LIBOR) on $200.0 of Energizer's variable rate debt through June 2022 at an interest

rate of 2.22%.

The Senior Notes were sold to qualified institutional buyers and will not be registered under the Securities Act or applicable

state securities laws. Interest is payable semi-annually on the Senior Notes, beginning on December 15, 2015. The Senior

Notes are fully and unconditionally guaranteed, jointly and severally, on an unsecured basis by each of Energizer's domestic

restricted subsidiaries that is a borrower or guarantor under the Revolving Facility and Term Loan.

The Revolving Facility will be used for working capital and for general corporate purposes. The proceeds of the Term Loan

and the Senior Notes were transferred to Edgewell in connection with the contribution of certain assets to Energizer

immediately prior to the completion of the spin-off. See Note 12, Transactions with Edgewell.

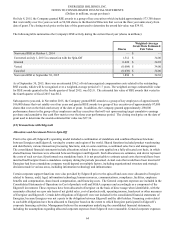

Debt Covenants

The credit agreements governing the Company's debt agreements contain certain customary representations and warranties,

affirmative covenants and provisions relating to events of default. If the Company fails to comply with these covenants or with

other requirements of these credit agreements, the lenders may have the right to accelerate the maturity of the debt.

Acceleration under one of these facilities would trigger cross defaults to other borrowings. As of September 30, 2015, the

Company was, and expects to remain, in compliance with the provisions and covenants associated with its debt agreements.

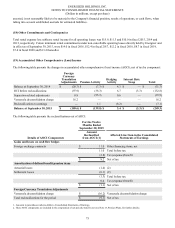

Aggregate maturities of long-term debt, including current maturities, at September 30, 2015 were as follows: $3.0 in one year,

$4.0 in two years, $4.0 in three years, $4.0 in four years, $4.0 in five years and $980.0 thereafter.

The counterparties to long-term committed borrowings consist of a number of major financial institutions. The Company

consistently monitors positions with, and credit ratings of, counterparties both internally and by using outside ratings agencies.