Energizer 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

Part II.

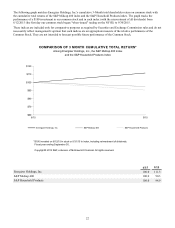

Item 5. Market for Registrant's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity

Securities.

The Company's Common Stock is listed on the New York Stock Exchange (NYSE). As of September 30, 2015, there were

approximately 9,480 shareholders of record of the Company's Common Stock.

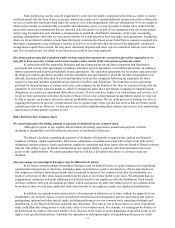

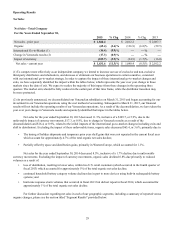

The following table sets forth the range of market prices for the period from June 12, 2015 to June 30, 2015, when the

Company was trading on a "when issued" basis, and post separation from July 1, 2015 to September 30, 2015.

Market Price Range FY 2015

Third Quarter (June 12, 2015 - June 30, 2015) $ 33.00 - $35.00

Fourth Quarter $ 34.00 - $42.31

On January 9, 2015, Energizer issued 1,000 shares of its common stock to its former parent pursuant to Section 4(a)(2) of the

Securities Act of 1933, as amended (Securities Act). We did not register the issuance of the issued shares under the Securities Act

because such issuance did not constitute a public offering.

On June 30, 2015, in connection with the consummation of the Spin-Off, Energizer and Edgewell entered into the Contribution

Agreement (the “Contribution Agreement”) pursuant to which Energizer issued to Edgewell 62,192,281 shares of Energizer’s

common stock, par value $0.01 per share, and transferred approximately $1 billion in cash, to Edgewell in connection with

Edgewell’s contribution of certain assets to Energizer immediately prior to the completion of the Spin-Off. To the extent applicable,

the issuance of shares by Energizer to Edgewell pursuant to the Contribution Agreement was exempt from registration pursuant

to Section 4(a)(2) of the Securities Act of 1933, as amended.

The Company made a quarterly dividend payment of $0.25 per share during the fourth fiscal quarter of 2015. The Company

expects to continue to pay regular quarterly dividends. Future dividends are dependent on future earnings, capital requirements

and the Company's financial condition and are declared at the sole discretion of the Company's Board of Directors. See Item

1A - Risk Factors - Risks Related to Our Common Stock - We cannot guarantee the timing, amount or payment of dividends on

our common stock.”

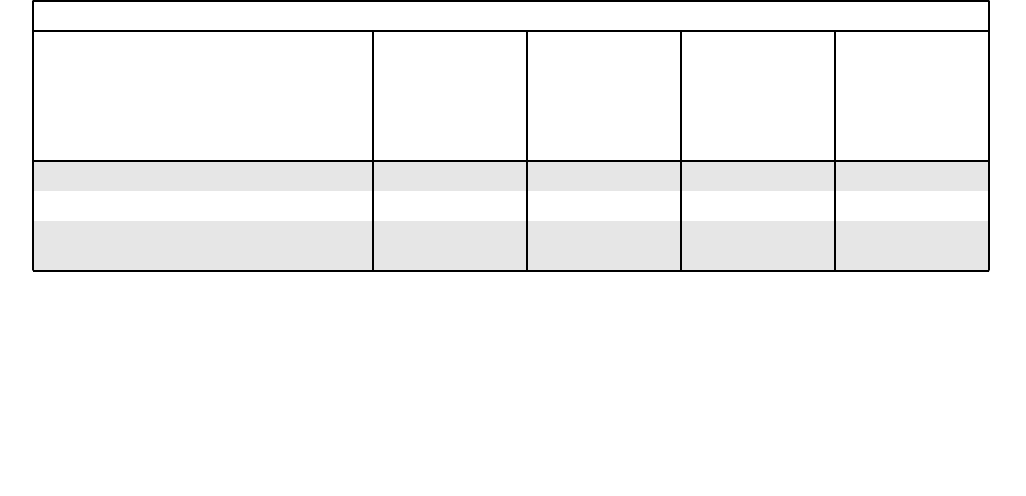

Issuer Purchases of Equity Securities. The following table reports purchases of equity securities during the fourth quarter of

fiscal 2015 by Energizer and any affiliated purchasers pursuant to SEC rules, including any treasury shares withheld to satisfy

employee withholding obligations upon vesting of restricted stock and the execution of net exercises.

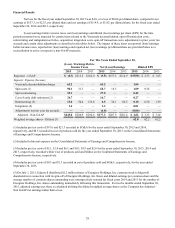

Issuer Purchases of Equity Securities

Period

Total Number of

Shares Purchased

(1) Average Price

Paid Per Shares

Total Number of

Shares Purchased

as Part of

Publicly

Announced Plans

or Programs (2)

Maximum

Number That

May Yet Be

Purchased Under

the Plans or

Programs

July 1, 2015 - July 31, 2015 1,197 $ 42.00 — 7,500,000

August 1, 2015 - August 31, 2015 — — — 7,500,000

September 1, 2015 - September 30, 2015 1,018 $ 40.49 — 7,500,000

(1) 2,215 shares purchased during the quarter relate to the surrender to the Company of shares of common stock to satisfy tax

withholding obligations in connection with the vesting of restricted stock or execution of net exercises.

(2) On July 1, 2015, the Board of Directors approved a new share repurchase authorization for the repurchase of up to 7.5

million shares. No shares were repurchased on the open market during the fiscal year under this share repurchase

authorization. Subsequent to the end of fiscal 2015 and through the date of this report, the Company has repurchased

approximately 580,000 shares of its common stock at an average price of $36.30 per share.

From October 1, 2015 through November 17, 2015, an additional 90,040 shares were surrendered to the Company to satisfy tax

withholding obligations in connection with the vesting of restricted stock.