Energizer 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

Other financing, net was income of $18.4 in fiscal 2015 reflecting the net impact of hedging contract gains, interest

income and net revaluation gains on nonfunctional currency balance sheet exposures. Other financing, net was expense of $0.7

in fiscal 2014 reflecting the net impact of hedging contract gains and interest income offset by revaluation losses on

nonfunctional currency balance sheet exposures. In fiscal 2013, Other financing, net was an expense of $3.1 due largely to a

loss of $1.9 related to the termination of certain commodity derivative contracts.

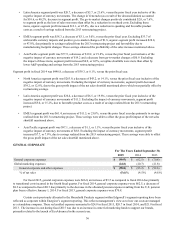

Income Taxes

For fiscal 2015, the effective tax rate was 455.1%. This rate was largely impacted by the Venezuela deconsolidation

charge of $65.2, which had no accompanying tax benefit. Partially offsetting this expense were pre-tax losses in high tax rate

jurisdictions driven by spin costs of $137.2, interest payments as a result of the early debt retirement of $26.7 and restructuring

charges of $13.0. Excluding the tax impact of these specific or unusual items, the non-GAAP effective tax rate for fiscal year

2015 was 27.0%, consistent with fiscal year 2014.

For fiscal 2014, the effective tax rate was 26.9%, which was favorably impacted by costs related to the separation and

the 2013 restructuring project. Both of these charges were primarily incurred in the U.S., which resulted in a higher tax benefit

as compared to our overall global effective tax rate. Excluding the impact of these items, the non-GAAP effective tax rate for

fiscal year 2014 was 27.5%. This rate was more favorable versus the prior year due to the mix of countries from which

earnings were derived as foreign earnings increased in lower tax rate countries, most significantly Singapore.

For fiscal 2013, the effective tax rate was 29.1%, which was favorably impacted by costs associated with our 2013

restructuring project that have been primarily incurred in the U.S., which has resulted in a higher tax benefit as compared to our

overall global effective tax rate, and to a lesser extent, the favorable impact of items such as the retroactive reinstatement of the

R&D credit. Excluding the impact of these specific items, the non-GAAP effective tax rate for fiscal year 2013 was 31.7%.

Energizer’s effective tax rate is highly sensitive to the mix of countries from which earnings or losses are derived.

Declines in earnings in lower tax rate countries, earnings increases in higher tax rate countries, repatriation of foreign

earnings or foreign operating losses in the future could increase future tax rates.

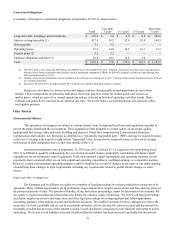

Venezuela Deconsolidation Charge

Venezuelan exchange control regulations have resulted in an other-than-temporary lack of exchangeability

between the Venezuelan bolivar and U.S. dollar, and have restricted our Venezuelan operations’ ability to pay dividends

and settle intercompany obligations. The severe currency controls imposed by the Venezuelan government have

significantly limited Energizer’s ability to realize the benefits from earnings of Energizer’s Venezuelan operations and

access the resulting liquidity provided by those earnings. Energizer expects that this condition will continue for the

foreseeable future. This lack of exchangeability has resulted in a lack of control over our Venezuelan subsidiaries for

accounting purposes. We deconsolidated our Venezuelan subsidiaries on March 31, 2015 and began accounting for our

investment in our Venezuelan operations using the cost method of accounting. Subsequent to March 31, 2015, our

financial results will not include the operating results of our Venezuelan operations. Instead, we will record revenue for

sales of inventory to our Venezuelan operations in our consolidated financial statements to the extent cash is received.

Further, dividends from our Venezuelan subsidiaries will be recorded as other income upon receipt of the cash. Included

within the results for the twelve months ended September 30, 2015, for Venezuela are net sales of $8.5 and segment profit

of $2.5. See further discussion in "Segment Results" below.

As a result of deconsolidating its Venezuelan subsidiaries at March 31, 2015, Edgewell recorded a one-time

charge of $144.5 in the second quarter of 2015, of which $65.2 was allocated to Energizer based on the Venezuelan

operations being distributed as part of Energizer. This charge included:

• foreign currency translation losses previously recorded in accumulated other comprehensive income, of

which $16.2 was allocated to Energizer

• the write-off of Edgewell’s Venezuelan operations’ cash balance, of which $44.6 was allocated to Energizer, (at

the 6.30 per U.S. dollar rate)

• the write-off of Edgewell’s Venezuelan operations’ other net assets, of which $4.4 was allocated to Energizer