Energizer 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

59

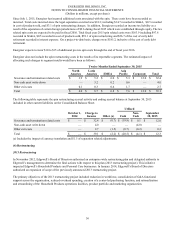

intercompany obligations. The severe currency controls imposed by the Venezuelan government have significantly limited

Energizer’s ability to realize the benefits from earnings of Edgewell’s Venezuelan operations and access the resulting liquidity

provided by those earnings. We expect that this condition will continue for the foreseeable future. This lack of exchangeability

has resulted in a lack of control over Edgewell’s Venezuelan subsidiaries for accounting purposes. Edgewell deconsolidated its

Venezuelan subsidiaries on March 31, 2015 and began accounting for its investment in its Venezuelan operations using the cost

method of accounting. As a result of deconsolidating its Venezuelan subsidiaries, Edgewell recorded a one-time charge of

$144.5 in the second quarter of 2015, of which $65.2 was allocated to Energizer based on the Venezuelan operations being

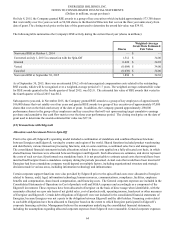

distributed as part of Energizer. This charge included:

• foreign currency translation losses previously recorded in accumulated other comprehensive income, of which $16.2

was allocated to Energizer

• the write-off of Edgewell’s Venezuelan operations’ cash balance, of which $44.6 was allocated to Energizer, (at the

6.30 per U.S. dollar rate)

• the write-off of Edgewell’s Venezuelan operations’ other net assets, of which $4.4 was allocated to Energizer

Since the deconsolidation as of March 31, 2015, Energizer's financial results do not include the operating results of the

Venezuelan operations. Instead, Energizer records revenue for sales of inventory to our Venezuelan operations in our

consolidated financial statements to the extent cash is received. Further, dividends from Energizer’s Venezuelan subsidiaries are

recorded as other income upon receipt of the cash. Included within the results for the twelve months ended September 30, 2015,

for Venezuela are net sales of $8.5 and segment profit of $2.5 recorded in the first six months of the year, and net sales of $25.8

and $28.4 and segment profit of $13.1 and $13.0 for the twelve months ended September 30, 2014 and 2013, respectively.

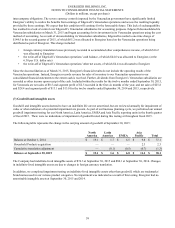

(7) Goodwill and intangible assets

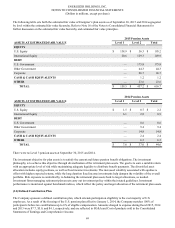

Goodwill and intangible assets deemed to have an indefinite life are not amortized, but are reviewed annually for impairment of

value or when indicators of a potential impairment are present. As part of our business planning cycle, we performed our annual

goodwill impairment testing for our North America, Latin America, EMEA and Asia Pacific reporting units in the fourth quarter

of fiscal 2015. There were no indications of impairment of goodwill noted during this testing or throughout fiscal 2015.

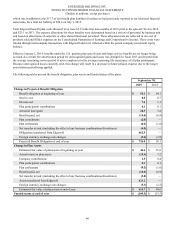

The following table represents the change in the carrying amount of goodwill at September 30, 2015:

North

America Latin

America EMEA Asia

Pacific Total

Balance at October 1, 2014 $ 19.1 $ 1.7 $ 6.5 $ 9.8 $ 37.1

Household Products acquisition — — — 2.3 2.3

Cumulative translation adjustment — (0.1)(0.5)(0.7)(1.3)

Balance at September 30, 2015 $ 19.1 $ 1.6 $ 6.0 $ 11.4 $ 38.1

The Company had indefinite-lived intangible assets of $76.3 at September 30, 2015 and $80.1 at September 30, 2014. Changes

in indefinite-lived intangible assets are due to changes in foreign currency translation.

In addition, we completed impairment testing on indefinite-lived intangible assets other than goodwill, which are trademarks/

brand names used in our various product categories. No impairment was indicated as a result of this testing. Energizer had no

amortizable intangible assets at September 30, 2015 and 2014.