Energizer 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

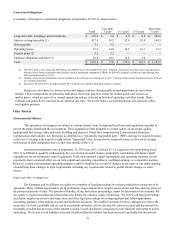

Liquidity and Capital Resources

Energizer’s primary future cash needs will be centered on operating activities, working capital and strategic

investments. We believe that our future cash from operations, together with our access to capital markets, will provide

adequate resources to fund our operating and financing needs, our access to, and the availability of, financing on

acceptable terms in the future will be affected by many factors, including: (i) our credit rating, (ii) the liquidity of the

overall capital markets and (iii) the current state of the economy. Moreover, to preserve the tax-free treatment of the

separation, Energizer may not be able to engage in certain strategic or capital-raising transactions following the

separation, such as issuing equity securities beyond certain thresholds, which may limit Energizer’s access to capital

markets, or making acquisitions using its equity as currency, potentially requiring Energizer to issue more debt than

would otherwise be optimal. There can be no assurances that we will continue to have access to capital markets on terms

acceptable to us. See “Risk Factors” for a further discussion.

Cash is managed centrally with net earnings reinvested locally and working capital requirements met from existing

liquid funds. At September 30, 2015, Energizer had $502.1 of cash and cash equivalents, 95% of which was outside of the

U.S. Given our extensive international operations, a significant portion of our cash is denominated in foreign currencies. We

manage our worldwide cash requirements by reviewing available funds among the many subsidiaries through which we

conduct our business and the cost effectiveness with which those funds can be accessed. The repatriation of cash balances

from certain of our subsidiaries could have adverse tax consequences or be subject to regulatory capital requirements;

however, those balances are generally available without legal restrictions to fund ordinary business operations.

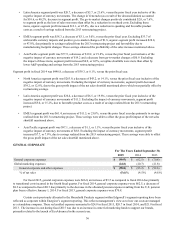

On June 1, 2015, the Company entered into a credit agreement which provides for a five-year $250.0 senior secured

revolving credit facility (Revolving Facility) and a seven-year $400.0 senior secured term loan B facility (Term Loan) that

became effective on June 30, 2015. Also on June 1, 2015, Energizer completed the issuance and sale of $600.0 of 5.50%

Senior Notes due 2025 (Senior Notes), with proceeds placed in escrow and released June 30, 2015.

Borrowings under the Revolving Facility will bear interest at LIBOR plus the applicable margin based on total

Company leverage. As of September 30, 2015, the Company did not have outstanding borrowings under the Revolving Facility

and had $6.4 of outstanding letters of credit. Taking into account outstanding letters of credit, $243.6 remains available as of

September 30, 2015.

Debt Covenants

The credit agreements governing the Company's debt agreements contain certain customary representations and warranties,

affirmative covenants and provisions relating to events of default. If the Company fails to comply with these covenants or with

other requirements of these credit agreements, the lenders may have the right to accelerate the maturity of the debt.

Acceleration under one of these facilities would trigger cross defaults to other borrowings. As of September 30, 2015, the

Company was, and expects to remain, in compliance with the provisions and covenants associated with its debt agreements.

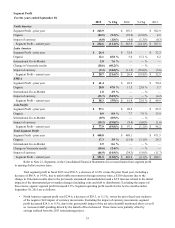

Operating Activities

Cash flow from operating activities is the primary funding source for operating needs and capital investments. Cash

flow from operating activities was $161.8 in fiscal 2015, $219.9 in fiscal 2014, and $329.6 in fiscal 2013.

The decrease of $58.1 in cash flow from operating activities in fiscal 2015 as compared to fiscal 2014 was primarily

driven by lower net earnings resulting from the negative impact of currencies and cash expenditures related to the separation,

most notably spent in the third fiscal quarter. The cash expenditures related to the separation were partially offset by

improvements in working capital of $64.2 versus fiscal 2014.

The decrease in cash flow of $109.7 from operating activities in fiscal 2014 as compared to fiscal 2013 was due

primarily to improvements in managed working capital. We define managed working capital as accounts receivable (less trade

allowance in accrued liabilities), inventory and accounts payable. Cash flow from operating activities related to changes in

assets and liabilities used in operations was a (use)/source of cash of ($2.5) versus $156.7 in fiscal years 2014 and 2013,

respectively. This significant improvement was due primarily to Energizer’s multi-year initiative to improve managed working

capital. Energizer realized a significant improvement in accounts receivable in fiscal 2013. Due to this improvement, the

Company recognized a one-time benefit in operating cash flow during fiscal 2013 and was able to maintain the improvement in

fiscal 2014.