Energizer 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

54

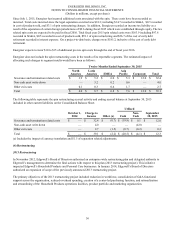

Revenue Recognition – Energizer’s revenue is from the sale of its products. Revenue is recognized when title, ownership

and risk of loss pass to the customer. Discounts are offered to customers for early payment and an estimate of the discount is

recorded as a reduction of net sales in the same period as the sale. Our standard sales terms are final and returns or exchanges

are not permitted unless a special exception is made. Reserves are established and recorded in cases where the right of return

does exist for a particular sale.

Energizer offers a variety of programs, such as consumer coupons and similar consumer rebate programs, primarily to its

retail customers, designed to promote sales of its products. Such programs require periodic payments and allowances based on

estimated results of specific programs and are recorded as a reduction to net sales. Energizer accrues, at the time of sale, the

estimated total payments and allowances associated with each transaction. Additionally, Energizer offers programs directly to

consumers to promote the sale of its products. Promotions which reduce the ultimate consumer sale prices are recorded as a

reduction of net sales at the time the promotional offer is made, generally using estimated redemption and participation levels.

Taxes we collect on behalf of governmental authorities, which are generally included in the price to the customer, are also

recorded as a reduction of net sales. Energizer continually assesses the adequacy of accruals for customer and consumer

promotional program costs not yet paid. To the extent total program payments differ from estimates, adjustments may be

necessary. Historically, these adjustments have not been material.

Advertising and Sales Promotion Costs – The Company advertises and promotes its products through national and regional

media and expenses such activities as incurred. Advertising costs were $87.5, $70.7, and $83.6 for the fiscal years ended

September 30, 2015, 2014, 2013, respectively.

Research and Development Costs - The Company expenses research and development costs as incurred.

Income Taxes – Our annual effective income tax rate is determined based on our income, statutory tax rates and the tax impacts

of items treated differently for tax purposes than for financial reporting purposes. Tax law requires certain items be included in

the tax return at different times than the items are reflected in the financial statements. Some of these differences are permanent,

such as expenses that are not deductible in our tax return, and some differences are temporary, reversing over time, such as

depreciation expense. These temporary differences create deferred tax assets and liabilities.

The Company regularly repatriates a portion of current year earnings from select non-U.S. subsidiaries. Generally, these non-

U.S. subsidiaries are in tax jurisdictions with effective tax rates that do not result in materially higher U.S. tax provisions

related to the repatriated earnings. No provision is made for additional taxes on undistributed earnings of foreign affiliates that

are intended and planned to be indefinitely invested in foreign affiliates. The Company intends to reinvest these earnings

indefinitely in our foreign subsidiaries to fund local operations, fund strategic growth objectives, and fund capital projects. See

Note 8, Income Taxes, for further discussion.

The Company estimates income taxes and the effective income tax rate in each jurisdiction that it operates. This involves

estimating taxable earnings, specific taxable and deductible items, the likelihood of generating sufficient future taxable income

to utilize deferred tax assets, the portion of the income of foreign subsidiaries that is expected to be remitted to the U.S. and be

taxable and possible exposures related to future tax audits. Deferred tax assets are evaluated on a subsidiary by subsidiary basis

to ensure that the asset will be realized. Valuation allowances are established when the realization is not deemed to be more

likely than not. Future performance is monitored, and when objectively measurable operating trends change, adjustments are

made to the valuation allowances accordingly. To the extent the estimates described above change, adjustments to income taxes

are made in the period in which the estimate is changed.

The Company operates in multiple jurisdictions with complex tax and regulatory environments, which are subject to differing

interpretations by the taxpayer and the taxing authorities. At times, the Company may take positions that management believes

are supportable, but are potentially subject to successful challenges by the appropriate taxing authority. The Company evaluates

its tax positions and establishes liabilities in accordance with guidance governing accounting for uncertainty in income taxes.

The Company reviews these tax uncertainties in light of the changing facts and circumstances, such as the progress of tax

audits, and adjusts them accordingly.

Share-Based Payments – The Company grants restricted stock equivalents, which generally vest over two to four years. Stock

compensation expense is measured at the grant date based on the estimated fair value of the award and is recognized on a

straight-line basis over the full restriction period of the award.