Energizer 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

58

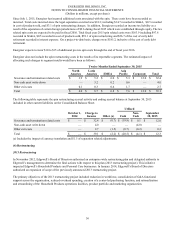

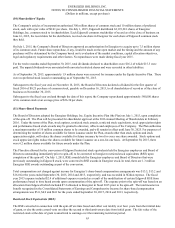

The following table summarizes the activity related to the 2013 restructuring project for the twelve months ended September

30, 2015 and 2014.

Utilized

October 1,

2014 Charge to

Income Other (a) Cash Non-

Cash September 30,

2015

Severance & Termination Related Costs $ 12.4 $ 7.0 $ (2.3) $ (13.1) $ — $ 4.0

Accelerated Depreciation — 9.1 — — (9.1) —

Other Costs — 4.5 — (4.5) — —

Net loss on asset sale — (11.0) 0.3 13.7 (3.0) —

Total $ 12.4 $ 9.6 $ (2.0) $ (3.9) $ (12.1) $ 4.0

Utilized

October 1,

2013 Charge to

Income Other (a) Cash Non-

Cash September 30,

2014

Severance & Termination Related Costs $ 13.8 $ 11.5 $ (0.3) $ (12.6) $ — $ 12.4

Accelerated Depreciation — 4.1 — — (4.1) —

Other Costs 5.7 25.5 — (29.9)(1.3) —

Net loss on asset sale — 2.4 — 4.9 (7.3) —

Total $ 19.5 $ 43.5 $ (0.3) $ (37.6) $ (12.7) $ 12.4

(a) Includes the impact of currency translation and $4.1 of separation related adjustments in fiscal 2015.

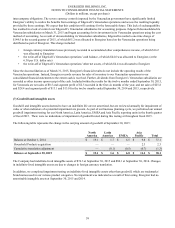

(5) Acquisitions

On December 12, 2014, Edgewell, on behalf of Energizer, completed an acquisition of a battery manufacturing facility in China

related to the Household Products business for approximately $12.1, primarily related to the purchase of fixed assets. As of

September 30, 2015, the purchase price allocation was complete. We have determined the fair values of assets acquired and

liabilities assumed for purposes of allocating the purchase price in accordance with accounting guidance for business

combinations. Based on the allocation of the purchase price, this transaction resulted in approximately $2.3 of goodwill.

(6) Venezuela

Effective January 1, 2010, the financial statements for our Venezuela subsidiary were consolidated under the rules governing

the translation of financial information in a highly inflationary economy based on the use of the blended National Consumer

Price Index in Venezuela. Under generally accepted accounting principles, an economy is considered highly inflationary if the

cumulative inflation rate for a three-year period meets or exceeds 100%. If a subsidiary is considered to be in a highly

inflationary economy, the financial statements of the subsidiary must be remeasured into our reporting currency (U.S. dollar)

and future exchange gains and losses from the re-measurement of monetary assets and liabilities are reflected in current

earnings, rather than exclusively in the equity section of the balance sheet, until such times as the economy is no longer

considered highly inflationary.

Prior to March 31, 2015, Edgewell included the results of its Venezuelan operations in its consolidated financial statements

using the consolidation method of accounting. Edgewell’s Venezuelan earnings and cash flows were reflected in their

consolidated financial statements at the official exchange rate of 6.30 bolivars per U.S. dollar for the sixth months ended March

31, 2015. At March 31, 2015, Edgewell had $33.8 of USD intercompany receivables due from its Venezuela subsidiaries, for

household and personal care products previously imported, the majority of which have been outstanding since Fiscal 2010. As

of March 31, 2015, Edgewell’s Venezuela subsidiary held bolivar denominated cash deposits of $93.8 (at the 6.30 per U.S.

dollar rate).

Venezuelan exchange control regulations have resulted in an other-than-temporary lack of exchangeability between the

Venezuelan bolivar and U.S. dollar, and have restricted Edgewell’s Venezuelan operations’ ability to pay dividends and settle