Energizer 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

67

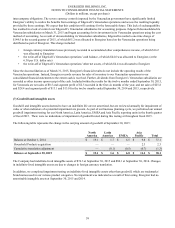

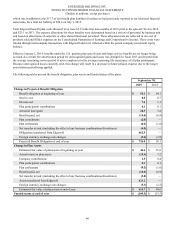

The following table presents the amounts recognized in the Consolidated Balance Sheets and Consolidated Statements of

Shareholders’ Equity:

September 30,

2015 2014

Amounts Recognized in the Consolidated

Balance Sheets

Noncurrent assets $ 5.9 $ —

Current liabilities (2.8)—

Noncurrent liabilities (112.4)(13.5)

Net amount recognized $(109.3)$(13.5)

Amounts Recognized in Accumulated Other Comprehensive Loss

Net loss, pre tax $ 211.0 $ 8.3

Included in the Accumulated Other Comprehensive Loss balance at September 30, 2015 was $145.8 of gross accumulated loss

associated with the pension plans transferred from Edgewell at July 1, 2015.

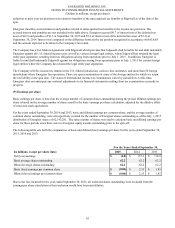

Pre-tax changes recognized in other comprehensive income for the year ended September 30, 2015 are as follows:

Changes in plan assets and benefit obligations recognized in other comprehensive loss

Net loss/(gain) arising during the year $ 59.9

Effect of exchange rates (1.5)

Amounts recognized as a component of net periodic benefit cost

Amortization or settlement recognition of net (loss)/gain (1.5)

Total recognized in other comprehensive income $ 56.9

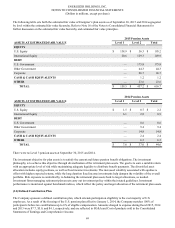

Energizer expects to contribute $5.2 to its plans in fiscal 2016.

Energizer’s expected future benefit payments for the plans are as follows:

For The Years Ending September 30,

2016 $ 55.9

2017 46.8

2018 47.2

2019 47.2

2020 46.0

2021 to 2025 223.0

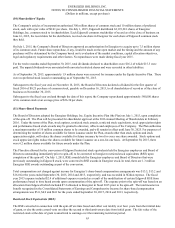

The accumulated benefit obligation for the plans was $609.4 and $45.0 at September 30, 2015 and 2014, respectively. The

following table shows the plans with an accumulated benefit obligation in excess of plan assets at the dates indicated.

September 30,

2015 2014

Projected benefit obligation $ 726.0 $ 58.1

Accumulated benefit obligation $ 609.4 $ 45.0

Estimated fair value of plan assets $ 616.7 $ 44.6

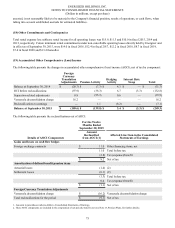

Pension plan assets in the U.S. plan represent approximately 75% of assets in all of the Company's defined benefit pension

plans. Investment policy for the U.S. plan includes a mandate to diversify assets and invest in a variety of assets classes to