Energizer 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

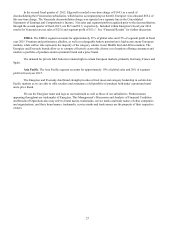

Item 6. Selected Financial Data.

All amounts discussed are in millions of U.S. dollars, unless otherwise indicated.

We derived the selected statements of earnings data for the years ended September 30, 2015, 2014, 2013, and 2012 and

selected balance sheet data as of September 30, 2015, 2014 and 2013, as set forth below, from our audited Consolidated

Financial Statements. We derived the selected statements of earnings data for the year ended September 30, 2011 and the

selected balance sheet data as of September 30, 2012 and 2011 from Energizer’s unaudited underlying financial records, which

were derived from the financial records of Edgewell. The historical results do not necessarily indicate the results expected for

any future period. To ensure a full understanding, you should read the selected historical financial data presented below in

conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the

Consolidated Financial Statements and accompanying notes included elsewhere in this Annual Report.

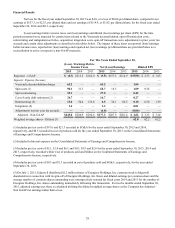

For The Years Ended September 30,

2015 2014 2013 2012 2011

Statements of Earnings Data

Net sales $ 1,631.6 $ 1,840.4 $ 2,012.2 $ 2,087.7 $ 2,196.0

Depreciation and amortization 41.8 42.2 55.9 56.8 (a)

(Loss)/earnings before income taxes (0.7)215.2 162.0 257.6 (a)

Income taxes 3.3 57.9 47.1 70.6 (a)

Net (loss)/earnings $(4.0)$ 157.3 $ 114.9 $ 187.0 (a)

(Loss)/earnings per share: (b)

Basic $(0.06)$ 2.53 $ 1.85 $ 3.01 (a)

Diluted $(0.06)$ 2.53 $ 1.85 $ 3.01 (a)

Average shares outstanding: (b)

Basic 62.2 62.2 62.2 62.2 (a)

Diluted 62.2 62.2 62.2 62.2 (a)

Dividend per common share (c) $ 0.25 $ — $ — $ — $ —

At September 30,

2015 2014 2013 2012 2011

Balance Sheet Data

Working capital (d) $ 658.7 $ 366.7 $ 357.9 $ 556.2 $ 587.9

Property, plant and equipment, net 205.6 212.5 240.6 318.0 338.1

Total assets 1,629.6 1,194.7 1,238.8 1,399.3 1,531.7

Long-term debt, including current maturities 998.0 ————

(a) Omission of data due to inability to provide this information without unreasonable effort and expense. A combination

of factors resulted in our inability to provide this information without unreasonable effort and expense; the

predominant factor being the existence of the underlying accounting data on a prior general ledger system. We believe

the omission of this selected financial data does not have a material impact on a reader’s understanding of our

financial results and related trends.

(b) On July 1, 2015, Edgewell Personal Care Company (Edgewell) distributed 62.2 million shares of Energizer Holdings,

Inc. (Energizer) common stock to Edgewell shareholders in connection with its spin-off of Energizer. See note 1,

Description of Business and Basis of Presentation to the Consolidated Financial Statements for more information.

Basic and diluted earnings per common share, and the average number of common shares outstanding were

retrospectively restated for the number of Energizer shares outstanding immediately following this transaction.

(c) The Company issued a $0.25 per share dividend in the fourth fiscal quarter of 2015.

(d) Working capital is current assets less current liabilities.