Energizer 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

69

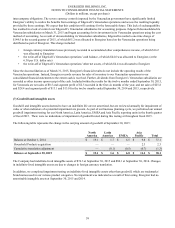

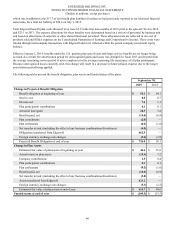

The following table sets forth the estimated fair value of Energizer’s plan assets as of September 30, 2015 and 2014 segregated

by level within the estimated fair value hierarchy. Refer to Note 16 of the Notes to Consolidated Financial Statements for

further discussion on the estimated fair value hierarchy and estimated fair value principles.

2015 Pension Assets

ASSETS AT ESTIMATED FAIR VALUE Level 1 Level 2 Total

EQUITY

U.S. Equity $ 138.9 $ 56.3 $ 195.2

International Equity 20.6 129.3 149.9

DEBT

U.S. Government — 175.8 175.8

Other Government — 44.3 44.3

Corporate — 26.7 26.7

CASH & CASH EQUIVALENTS — 1.2 1.2

OTHER — 23.6 23.6

TOTAL $ 159.5 $ 457.2 $ 616.7

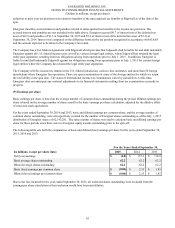

2014 Pension Assets

ASSETS AT ESTIMATED FAIR VALUE Level 1 Level 2 Total

EQUITY

U.S. Equity $ 1.5 $ 0.7 $ 2.2

International Equity 6.1 2.8 8.9

DEBT

U.S. Government — 0.6 0.6

Other Government — 9.4 9.4

Corporate — 14.8 14.8

CASH & CASH EQUIVALENTS — 2.4 2.4

OTHER — 6.3 6.3

TOTAL $ 7.6 $ 37.0 $ 44.6

There were no Level 3 pension assets at September 30, 2015 and 2014.

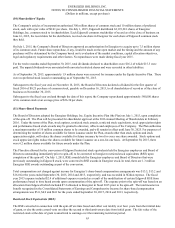

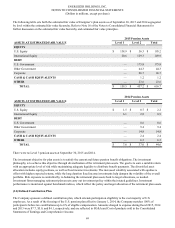

The investment objective for plan assets is to satisfy the current and future pension benefit obligations. The investment

philosophy is to achieve this objective through diversification of the retirement plan assets. The goal is to earn a suitable return

with an appropriate level of risk while maintaining adequate liquidity to distribute benefit payments. The diversified asset

allocation includes equity positions, as well as fixed income investments. The increased volatility associated with equities is

offset with higher expected returns, while the long duration fixed income investments help dampen the volatility of the overall

portfolio. Risk exposure is controlled by re-balancing the retirement plan assets back to target allocations, as needed.

Investment firms managing retirement plan assets carry out investment policy within their stated guidelines. Investment

performance is monitored against benchmark indices, which reflect the policy and target allocation of the retirement plan assets.

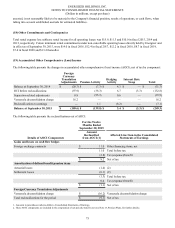

(14) Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends participation eligibility to the vast majority of U.S.

employees. As a result of the freezing of the U.S. pension plan effective January 1, 2014, the Company matches 100% of

participant’s before tax contributions up to 6% of eligible compensation. Amounts charged to expense during fiscal 2015, 2014

and 2013 were $7.7, $5.0, and $4.1, respectively, and are reflected in SG&A and Cost of products sold in the Consolidated

Statements of Earnings and Comprehensive Income.