Energizer 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

53

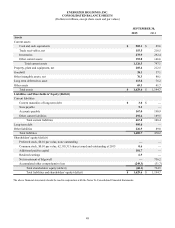

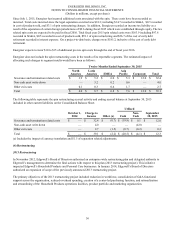

Trade Receivables, net consists of:

September 30,

2015 2014

Trade Receivables $ 162.5 $ 225.9

Allowance for returns and doubtful accounts (7.0)(7.4)

Trade Receivables, net $ 155.5 $ 218.5

Inventories – Inventories are valued at the lower of cost or market, with cost generally being determined using average cost or

the first-in, first-out (FIFO) method. The Company records a reserve for excess and obsolete inventory based upon the

historical usage rates, sales patterns of its products and specifically-identified obsolete inventory.

Capitalized Software Costs – Capitalized software costs are included in other assets. These costs are amortized using the

straight-line method over periods of related benefit ranging from three to seven years. Expenditures related to capitalized

software are included in the Capital expenditures caption in the Consolidated Statements of Cash Flows. For the twelve months

ended September 30, 2015, 2014 and 2013, amortization expense was $4.7, $1.9 and $1.1 in fiscal 2015, 2014 and 2013,

respectively.

Property, Plant and Equipment, net – Property, plant and equipment, net is stated at historical costs. Expenditures for new

facilities and expenditures that substantially increase the useful life of property, including interest during construction, are

capitalized and reported in the Capital expenditures caption in the Consolidated Statements of Cash Flows. Maintenance,

repairs and minor renewals are expensed as incurred. When property is retired or otherwise disposed of, the related cost and

accumulated depreciation are removed from the accounts, and gains or losses on the disposition are reflected in earnings.

Depreciation is generally provided on the straight-line basis by charges to pre-tax earnings at rates based on estimated useful

lives. Estimated useful lives range from two to 25 years for machinery and equipment and three to 30 years for buildings and

building improvements. Depreciation expense was $37.1 in fiscal 2015, excluding accelerated depreciation charges of $9.1,

related primarily to certain manufacturing assets including property, plant and equipment located at the facilities to be closed or

streamlined, and $40.3 in fiscal 2014, excluding accelerated depreciation charges of $4.1, related primarily to certain

manufacturing assets including property, plant and equipment located at the facilities to be closed or streamlined, and $54.8 in

fiscal 2013, excluding non-cash impairment charge of $19.3 and accelerated depreciation charges of $23.6, respectively. See

Note 4, Restructuring, of the Notes to the Consolidated Financial Statements.

Estimated useful lives are periodically reviewed and, when appropriate, changes are made prospectively. When certain events

or changes in operating conditions occur, asset lives may be adjusted and an impairment assessment may be performed on the

recoverability of the carrying amounts.

Goodwill and Other Intangible Assets – Goodwill and indefinite-lived intangibles are not amortized, but are evaluated annually

for impairment as part of the Company's annual business planning cycle in the fourth fiscal quarter, or when indicators of a

potential impairment are present.

Impairment of Long-Lived Assets – Energizer reviews long-lived assets, other than goodwill and other intangible assets

for impairment, when events or changes in business circumstances indicate that the remaining useful life may warrant revision

or that the carrying amount of the long-lived asset may not be fully recoverable. Energizer performs undiscounted cash flow

analysis to determine if impairment exists. If impairment is determined to exist, any related impairment loss is calculated based

on estimated fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to be

received, less cost of disposal.

In November 2012, Edgewell’s Board of Directors authorized an enterprise-wide restructuring plan, which included the closure

of certain facilities in fiscal 2013, 2014 and 2015. As a result of the spin-off, Energizer was allocated and recorded a portion of

these expenses including accelerated depreciation charges of $9.1 and $4.1 for the twelve months ended September 30, 2015

and 2014, respectively and non-cash impairment charge of $19.3 and accelerated depreciation charges of $23.6 for twelve

months ended September 30, 2013 (collectively $42.9) related primarily to certain manufacturing assets including property,

plant and equipment located at the facilities to be closed or streamlined. We do not believe the restructuring plan is likely to

result in the impairment of any other material long-lived assets, other than this identified property, plant and equipment. See

Note 4 of the Notes to Consolidated Financial Statements.