Energizer 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

could damage our reputations or brands.

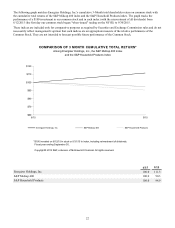

Other significant changes may occur in our cost structure, management, financing and business operations as a result of

operating as a company separate from our former parent. For additional information about the past financial performance of our

business and the basis of presentation of the historical consolidated financial statements see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and the historical financial statements and accompanying notes included

elsewhere in this Annual Report.

We may not achieve some or all of the expected benefits of the separation, and the separation may materially adversely

affect our business.

We may not be able to achieve the full strategic and financial benefits expected to result from the separation, or

such benefits may be delayed or not occur at all. We may not achieve these and other anticipated benefits for a variety of

reasons, including, among others: (a) we may be more susceptible to market fluctuations and other adverse events than if

we were still a part of our former parent because our business is less diversified than our former parent's business prior to

the completion of the separation; (b) we may be unable to obtain certain goods, services and technologies at prices or on

terms as favorable as those our former parent obtained prior to completion of the separation; and (c) the separation has

entailed changes to our information technology systems, reporting systems, supply chain and other operations that may

require significant expense and may not be implemented in an as timely and effective fashion as we expect. If we fail to

achieve some or all of the benefits expected to result from the separation, or if such benefits are delayed, it could have a

material adverse effect on our competitive position, financial condition, results of operations and cash flows.

In connection with our separation from our former parent, our former parent agreed to indemnify us for certain

liabilities and we agreed to indemnify our former parent for certain liabilities. If we are required to pay under these

indemnities to our former parent, our financial results could be negatively impacted. The indemnity from our former

parent may not be sufficient to hold us harmless from the full amount of liabilities for which our former parent was

allocated responsibility, and our former parent may not be able to satisfy its indemnification obligations in the future.

Pursuant to the separation agreement and certain other agreements with our former parent, our former parent

agreed to indemnify us for certain liabilities, and we agreed to indemnify our former parent for certain liabilities, in each

case for uncapped amounts. Indemnity payments that we may be required to provide to our former parent are not subject

to any cap, may be significant and could negatively impact our business, particularly indemnities relating to our actions

that could impact the tax-free nature of the separation and related transactions. Third parties could also seek to hold us

responsible for any of the liabilities that our former parent has agreed to retain. Any amounts we are required to pay

pursuant to these indemnification obligations and other liabilities could require us to divert cash that would otherwise

have been used in furtherance of our operating business. Further, the indemnity from our former parent may not be

sufficient to protect us against the full amount of such liabilities, and our former parent may not be able to fully satisfy its

indemnification obligations. Moreover, even if we ultimately succeed in recovering from our former parent any amounts

for which we are held liable, we may be temporarily required to bear these losses ourselves. Each of these risks could

negatively affect our business, financial condition and results of operations.

If the distribution, together with certain related transactions, does not qualify as a transaction that is generally tax free

for U.S. federal income tax purposes, we could be subject to significant tax liabilities and, in certain circumstances, we

could be required to indemnify our former parent for material taxes and other related amounts pursuant to

indemnification obligations under the tax matters agreement.

In connection with our spin-off, our former parent received an opinion of counsel regarding the qualification of the

distribution, together with certain related transactions, as a transaction that is generally tax free for U.S. federal income tax

purposes under Sections 355 and 368(a)(1)(D) of the Code. The opinion of counsel was based upon and relied on, among

other things, certain representations, statements and undertakings of Energizer, including those relating to the past and future

conduct of Energizer. If any of these representations, statements or undertakings are, or become, inaccurate or incomplete, or

if our former parent or Energizer breaches any of its covenants in the separation documents, the opinion of counsel may be

invalid and the conclusions reached therein could be jeopardized.

Notwithstanding the opinion of counsel, the Internal Revenue Service, which we refer to as the “IRS,” could

determine that the distribution, together with certain related transactions, should be treated as a taxable transaction if it

determines that any of the representations, assumptions or undertakings upon which the opinion of counsel was based are

false or have been violated, or if it disagrees with the conclusions in the opinion of counsel. The opinion of counsel is not

binding on the IRS and there can be no assurance that the IRS will not assert a contrary position.

Under the tax matters agreement with our former parent, Energizer may be required to indemnify our former parent

against any additional taxes and related amounts resulting from (i) an acquisition of all or a portion of the equity securities