Energizer 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

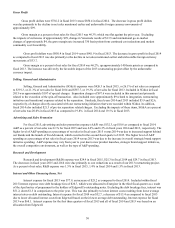

Spin Costs

Prior to the spin on July 1, 2015, Edgewell incurred costs to evaluate, plan and execute the spin transaction, and

Energizer was allocated a pro rata portion of those costs. Edgewell’s total spin costs through the close of the separation

were $358 on a pre-tax basis. Through the close of the separation, Energizer's allocation of these spin costs were

approximately $167.0 on a pre-tax basis; including $104.2 recorded in SG&A, $36.0 of spin restructuring charges and

$26.7 of cost of early debt retirement recorded in interest expense. The allocated amounts in SG&A included $82.9 and

$21.3 recorded in fiscal 2015 and 2014, respectively. The spin restructuring and cost of early debt retirement were

recorded fully in fiscal 2015.

Since July 1, 2015, Energizer has incurred additional costs associated with the spin. These costs have been

recorded on an actual basis as incurred. Total costs incurred since the legal separation occurred was $18.3; including

$14.7 recorded in SG&A, $0.5 recorded in cost of products sold, and $3.1 of spin restructuring charges. In addition,

Energizer incurred tax related spin costs in foreign jurisdictions of $9.6 during fiscal 2015 which were capitalized into

additional paid in capital. Total fiscal year 2015 spin related costs were $163.9 including $97.6 recorded in SG&A, $0.5

recorded in cost of products sold, $39.1 of spin restructuring and $26.7 of the cost of early debt retirement recorded in

interest expense. On a project-to-date basis, charges were $185.2, inclusive of the cost of early debt retirement.

Energizer expects to incur $10 to $15 of additional pre-tax spin costs through the end of fiscal year 2016.

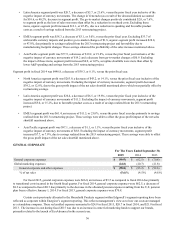

2013 Restructuring

For the fiscal year ended September 30, 2015 Energizer recorded pre-tax expense of $9.6, related to Edgewell’s

2013 restructuring. Pre-tax expense of $43.5 was recorded in the prior year comparative period by Energizer. The details

of the expense in each respective year are as follows:

• Accelerated depreciation charges of $9.1 for the twelve month period ended September 30, 2015 and $4.1 for the

twelve month period ended September 30, 2014, respectively;

• Severance and related benefit costs of $7.0 and $11.5 for the twelve months ended September 30, 2015 and 2014,

respectively, related to staffing reductions;

• Consulting, program management and other charges associated with the restructuring of $4.5 and $25.5 for the

twelve months ended September 30, 2015 and 2014, respectively; and,

• Net gain on the sale of fixed assets of $11.0 for the twelve months ended September 30, 2015 and net loss on the

sale of fixed assets of $2.4 for the twelve months ended September 30, 2014. The gain in fiscal 2015 was

recorded in the first fiscal quarter. The Asia battery packaging facility sold was closed as part of the restructuring

efforts.

For the twelve months ended September 30, 2013, Energizer recorded charges related to the 2013 restructuring project

of $123.9. Total pre-tax restructuring charges since the inception of the project and through September 30, 2015, have totaled

approximately $200. Restructuring charges were reflected on a separate line in the Consolidated Statements of Earnings and

Comprehensive Income. In addition, pre-tax costs of $1.1, $1.0 and $6.1 associated with certain inventory obsolescence charges

were recorded within Cost of products sold and $0.3, $5.9 and $2.6 associated with information technology enablement

activities were recorded within SG&A on the Consolidated Statements of Earnings and Comprehensive Income for the twelve

months ended September 30, 2015, 2014, and 2013, respectively. These inventory obsolescence and information technology

costs are considered part of the total project costs incurred for the 2013 restructuring project.

Fiscal 2015 marks the conclusion of the 2013 Restructuring Project as the full amount of savings are now included

within our run-rate cost structure. Energizer estimates that total project savings exceeded $218. The primary impacts of

savings were reflected in improved gross margin and lower overhead expenses. Savings related to the 2013 restructuring

project have been fully realized as of June 30, 2015. We do not expect additional charges to be material.

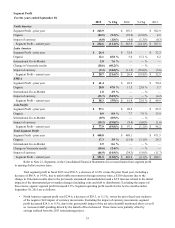

Segment Results

Operations for Energizer are managed via four major geographic segments - North America (U.S. and Canada),

Latin America, EMEA and Asia Pacific. Segment performance is evaluated based on segment operating profit, exclusive of

general corporate expenses, share-based compensation costs, costs associated with most restructuring initiatives, including

the 2013 restructuring project detailed above, the second fiscal quarter 2015 charge related to the Venezuela

deconsolidation, business realignment activities, research & development costs, amortization of intangible assets and other