Energizer 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

(including exits and shift to distributors). Excluding the impact of these items, organic sales decreased $65.4, or 3.6%.

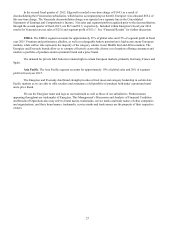

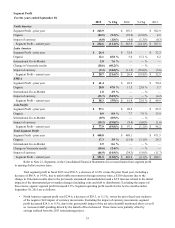

Segment sales results for the twelve months ended September 30, 2015 are as follows:

• North America net sales declined 8.6% versus the prior fiscal year, inclusive of a 0.9% decline due to

unfavorable currency movements. Excluding the impact of currency movements, organic net sales declined

7.7%. This decline was due primarily to the timing of holiday and promotional shipments and temporary prior

year shelf gains that were not repeated in the current fiscal year partially offset by increased shipments related

to the EcoAdvanced new product launch during the second fiscal quarter.

• Latin America net sales declined 22.8% versus the prior fiscal year, inclusive of a 9.7% decline due to

unfavorable currency movements. The deconsolidation of Venezuela accounted for a 10.7% year-over-year

decline while the go-to-market impacts had a negative impact of 2.7%. Excluding the impacts of currency

movements, Venezuela and the go-to-market changes, organic net sales increased 0.3% as pricing gains across

several markets were partially offset by volume declines due to the timing of holiday shipments and continued

category declines.

• EMEA net sales declined 11.6% versus the prior fiscal year, inclusive of a 14.2% decline due to unfavorable

currency movements. The go-to-market impacts associated with market exits and distributors positively contributed

to net sales by 0.3% due to pipeline fills associated with distributor changes. Excluding the impacts of currency

movements and go-to-market changes, organic net sales improved 2.3% due to volume increases associated with

new distribution, the continued roll out of EcoAdvanced and increased space gains in Western Europe.

• Asia Pacific net sales declined 12.9% versus the prior fiscal year, inclusive of a 7.5% decline due to unfavorable

currency movements and a 3.8% decline associated with the go-to-market changes. Excluding the impacts of

currency movements and go-to-market changes, organic net sales decreased 1.6% due to phasing of shipments and

heightened competitive pressures in two of our major markets, Australia and Korea.

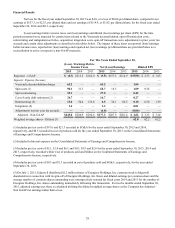

Net sales for the twelve months ended September 30, 2014 decreased 8.5%, inclusive of a 1.7% decline due to

unfavorable currency movements. Excluding the impact of currency movements, organic sales declined 6.8%. Segment sales

results for the twelve months ended September 30, 2014 are as follows:

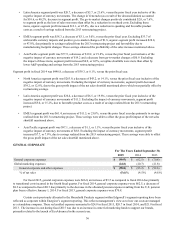

• North America net sales declined 12.7% versus the prior fiscal year, inclusive of a 0.5% decline due to unfavorable

impact of currency movements. Excluding the impact of currency movements, organic net sales declined 12.2% due

primarily to the loss of distribution within two U.S. retail customers (which occurred in the fourth fiscal quarter of

fiscal 2013), continued household battery category declines and hurricane response storm volumes that occurred in

fiscal 2013 but did not repeat in fiscal 2014.

• Latin America net sales declined 10.9% versus the prior fiscal year, inclusive of a 10.1% decline due to unfavorable

currency movements. Excluding the impact of currency movements, organic net sales declined 0.8% as pricing gains

across several markets were offset by volume declines due primarily to inventory import restrictions in Argentina and

Venezuela.

• EMEA net sales declined 1.0% versus the prior fiscal year, inclusive of a 0.3% benefit due to favorable impacts of

currency movements. Excluding the impact of currency movements, organic net sales declined 1.3% due to continued

household battery category declines.

• Asia Pacific net sales declined 4.1% versus the prior fiscal year, inclusive of a 3.4% decline due to unfavorable

impacts of currency movements. Excluding the impact of currency movements, organic net sales declined 0.7% due to

continued household battery category declines and increased competitive pressures.