Energizer 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

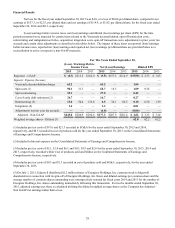

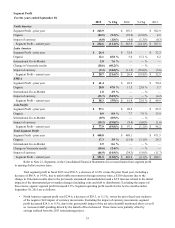

Financial Results

Net loss for the fiscal year ended September 30, 2015 was $4.0, or a loss of $0.06 per diluted share, compared to net

earnings of $157.3, or $2.53, per diluted share and net earnings of $114.9, or $1.85, per diluted share, for the fiscal year ended

September 30, 2014 and 2013, respectively.

(Loss)/earnings before income taxes, net (loss)/earnings and diluted (loss)/earnings per share (EPS) for the time

periods presented were impacted by certain items related to the Venezuela deconsolidation, spin-off transaction costs,

restructuring and realignment activities, acquisition integration costs, spin-off transaction costs, adjustments to prior years' tax

accruals and certain other adjustments as described in the tables below. The impact of these items on reported (loss)/earnings

before income taxes, reported net (loss)/earnings and reported net (loss)/earnings per diluted share are provided below as a

reconciliation to arrive at respective non-GAAP measures.

For The Years Ended September 30,

(Loss) / Earnings Before

Income Taxes Net (Loss)/Earnings Diluted EPS

2015 2014 2013 2015 2014 2013 2015 2014 2013

Reported - GAAP $ (0.7) $215.2 $162.0 $(4.0)$157.3 $114.9 $(0.06)$ 2.53 $ 1.85

Impacts: Expense (Income) —

Venezuela deconsolidation charge 65.2 — — 65.2 — — 1.04 — —

Spin costs (1) 98.1 21.3 — 68.7 16.5 — 1.09 0.26 —

Spin restructuring 39.1 — — 27.0 — — 0.43 — —

Cost of early debt retirement (2) 26.7 — — 16.7 — — 0.27 — —

Restructuring (3) 13.0 50.4 132.6 6.5 34.1 86.5 0.10 0.56 1.39

Integration (4) 1.6 — — 1.2 — — 0.01 — —

Adjustments to prior year tax accruals —— — (4.0)— — (0.06)— —

Adjusted - Non-GAAP $243.0 $286.9 $294.6 $177.3 $207.9 $201.4 $ 2.82 $ 3.35 $ 3.24

Weighted average shares - Diluted (5) 62.8 62.2 62.2

(1) Includes pre-tax costs of $97.6 and $21.3 recorded in SG&A for the years ended September 30, 2015 and 2014,

respectively, and $0.5 recorded in cost of products sold for the year ended September 30, 2015 on the Consolidated Statements

of Earnings and Comprehensive Income.

(2) Included in Interest expense on the Consolidated Statements of Earnings and Comprehensive Income.

(3) Includes pre-tax costs of $3.1, $1.0 and $6.1 and $0.3, $5.9 and $2.6 for the years ended September 30, 2015, 2014 and

2013, respectively, recorded within Cost of products sold and SG&A on the Combined Statements of Earnings and

Comprehensive Income, respectively.

(4) Includes pre-tax costs of $0.3 and $1.3 recorded in cost of products sold and SG&A, respectively, for the year ended

September 30, 2015.

(5) On July 1, 2015, Edgewell distributed 62.2 million shares of Energizer Holdings, Inc. common stock to Edgewell

shareholders in connection with its spin-off of Energizer Holdings, Inc. Basic and diluted earnings per common share and the

average number of common shares outstanding were retrospectively restated for fiscal years 2014 and 2013 for the number of

Energizer Holdings, Inc. shares outstanding immediately following this transaction. For twelve months ended September 30,

2015, adjusted earnings per share is calculated utilizing the diluted weighted average shares as the Company has Adjusted -

Non GAAP net earnings rather than a loss.