Dollar General 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

as our new store growth. We continually analyze and rebalance the network to ensure that it remains

efficient and provides the service our stores require. See ‘‘—Properties’’ for additional information

pertaining to our distribution centers.

Most of our merchandise flows through our distribution centers and is delivered to our stores by

third-party trucking firms, utilizing our trailers. Our agreements with these trucking firms are based on

estimated costs of diesel fuel, with the difference in estimated and current market fuel costs passed

through to us. The costs of diesel fuel are significantly influenced by international, political and

economic circumstances. Our average cost per gallon of diesel fuel increased slightly in 2012 and more

significantly in 2011. If further price increases were to arise for any reason, including fuel supply

shortages or unusual price volatility, the resulting higher fuel prices could materially increase our

transportation costs.

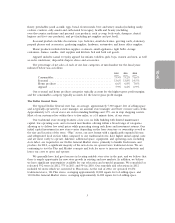

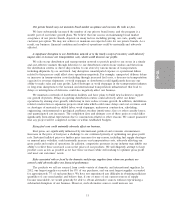

Seasonality

Our business is seasonal to a certain extent. Generally, our highest sales volume occurs in the

fourth quarter, which includes the Christmas selling season, and the lowest occurs in the first quarter.

In addition, our quarterly results can be affected by the timing of certain holidays, the timing of new

store openings and store closings, the amount of sales contributed by new and existing stores, as well as

financial transactions such as debt repurchases, common stock offerings and stock repurchases. We

purchase substantial amounts of inventory in the third quarter and incur higher shipping costs and

higher payroll costs in anticipation of the increased sales activity during the fourth quarter. In addition,

we carry merchandise during our fourth quarter that we do not carry during the rest of the year, such

as gift sets, holiday decorations, certain baking items, and a broader assortment of toys and candy.

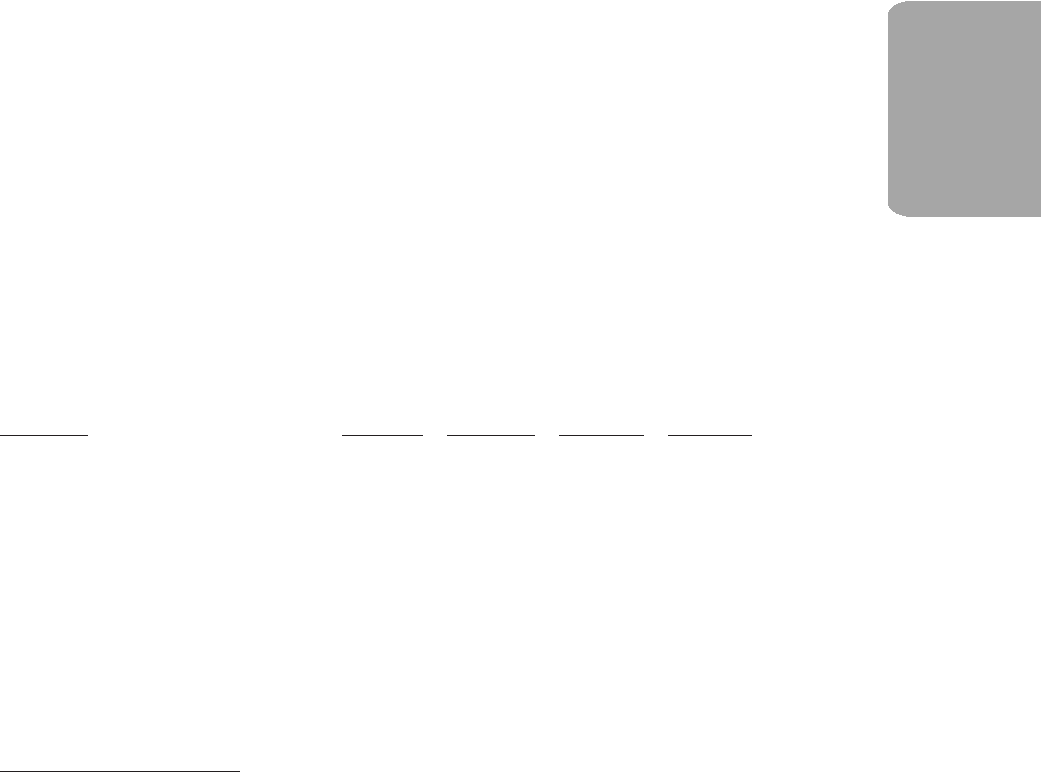

The following table reflects the seasonality of net sales, gross profit, and net income by quarter for

each of the quarters of our three most recent fiscal years. The fourth quarter of the year ended

February 3, 2012 was comprised of 14 weeks, and each of the other quarters reflected below were

comprised of 13 weeks.

(in millions) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Year Ended February 1, 2013

Net sales .................... $3,901.2 $3,948.7 $3,964.6 $4,207.6

Gross profit ................. 1,228.3 1,263.2 1,226.1 1,367.8

Net income(a) ................ 213.4 214.1 207.7 317.4

Year Ended February 3, 2012

Net sales .................... $3,451.7 $3,575.2 $3,595.2 $4,185.1

Gross profit ................. 1,087.4 1,148.3 1,115.8 1,346.4

Net income(b) ................ 157.0 146.0 171.2 292.5

Year Ended January 28, 2011

Net sales .................... $3,111.3 $3,214.2 $3,223.4 $3,486.1

Gross profit ................. 999.8 1,036.0 1,010.7 1,130.2

Net income .................. 136.0 141.2 128.1 222.5

(a) Includes expenses, net of income taxes, of $17.7 million related to the redemption of

long-term obligations in second quarter of 2012.

(b) Includes expenses, net of income taxes, of $35.4 million related to the redemption of

long-term obligations in second quarter of 2011.

7