Dollar General 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197

|

|

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

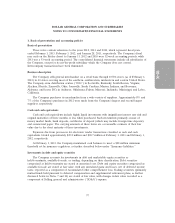

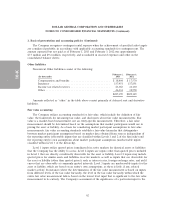

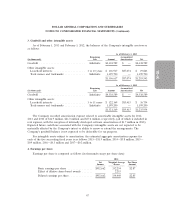

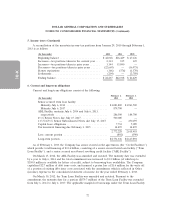

3. Goodwill and other intangible assets

As of February 1, 2013 and February 3, 2012, the balances of the Company’s intangible assets were

as follows:

As of February 1, 2013

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill ............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests .................... 1 to 10 years $ 106,917 $87,074 $ 19,843

Trade names and trademarks ............. Indefinite 1,199,700 — 1,199,700

$1,306,617 $87,074 $1,219,543

As of February 3, 2012

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill ............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests .................... 1 to 11 years $ 122,169 $85,415 $ 36,754

Trade names and trademarks ............. Indefinite 1,199,200 — 1,199,200

$1,321,369 $85,415 $1,235,954

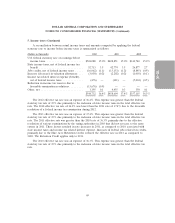

The Company recorded amortization expense related to amortizable intangible assets for 2012,

2011 and 2010 of $16.9 million, $21.0 million and $27.4 million, respectively, (all of which is included in

rent expense, with the exception of internally developed software amortization of $1.7 million in 2010).

Expected future cash flows associated with the Company’s intangible assets are not expected to be

materially affected by the Company’s intent or ability to renew or extend the arrangements. The

Company’s goodwill balance is not expected to be deductible for tax purposes.

For intangible assets subject to amortization, the estimated aggregate amortization expense for

each of the five succeeding fiscal years is as follows: 2013—$11.9 million, 2014—$5.8 million, 2015—

$0.9 million, 2016—$0.3 million and 2017—$0.2 million.

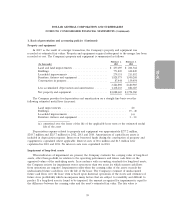

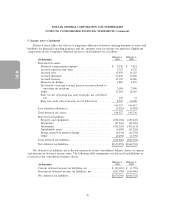

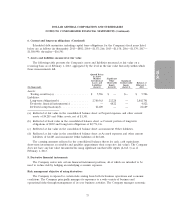

4. Earnings per share

Earnings per share is computed as follows (in thousands except per share data):

2012

Net Weighted Average Per Share

Income Shares Amount

Basic earnings per share ................ $952,662 332,254 $2.87

Effect of dilutive share-based awards ....... 2,215

Diluted earnings per share ............... $952,662 334,469 $2.85

67