Dollar General 2012 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197

|

|

10-K

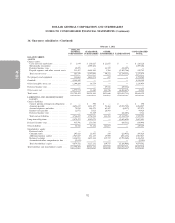

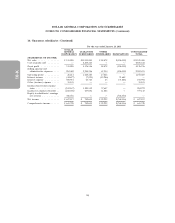

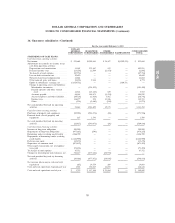

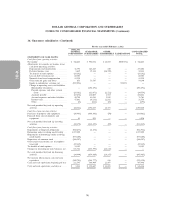

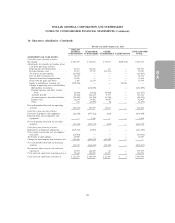

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. Quarterly financial data (unaudited) (Continued)

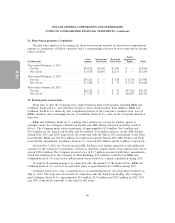

As discussed in Note 6, in the second quarter of 2012, the Company repurchased $450.7 million

principal amount of its outstanding senior subordinated notes due 2017, resulting in a pretax loss of

$29.0 million ($17.7 million net of tax, or $0.05 per diluted share) which was recognized as Other

(income) expense.

As discussed in Note 6, in the first quarter of 2011, the Company repurchased $25.0 million

principal amount of its outstanding senior notes due 2015, resulting in a pretax loss of $2.2 million

($1.3 million net of tax, or less than $0.01 per diluted share) which was recognized as Other (income)

expense.

As discussed in Note 6, in the second quarter of 2011, the Company repurchased $839.3 million

principal amount of its outstanding senior notes due 2015, resulting in a pretax loss of $58.1 million

($35.4 million net of tax, or $0.10 per diluted share) which was recognized as Other (income) expense.

As discussed in Note 11, in the fourth quarter of 2011 the Company incurred share-based

compensation expenses included in SG&A of $8.6 million ($5.3 million net of tax, or $0.02 per diluted

share) for the accelerated vesting of certain share-based awards in conjunction with a secondary

offering of the Company’s common stock.

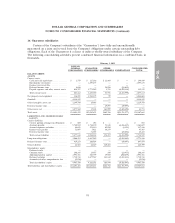

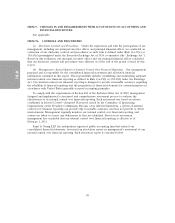

15. Subsequent event

On March 19, 2013, the Company’s Board of Directors authorized a $500 million increase in the

common stock repurchase program discussed in Note 2. The repurchase authorization has no expiration

date and allows repurchases from time to time in the open market or in privately negotiated

transactions, which could include repurchases from Buck Holdings, L.P. or other related parties if

appropriate. The timing and number of shares purchased depends on a variety of factors, such as price,

market conditions and other factors. Repurchases under the program may be funded from available

cash or borrowings under the ABL Facility discussed in Note 6.

90