Dollar General 2012 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. Commitments and contingencies (Continued)

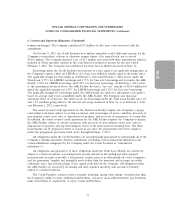

size of any potential class or the value of the claims asserted in Richter. For these reasons, the

Company is unable to estimate any potential loss or range of loss in the matter; however, if the

Company is not successful in its defense efforts, the resolution of Richter could have a material adverse

effect on the Company’s financial statements as a whole. The Company will continue to vigorously

defend its position in the Richter matter.

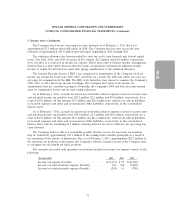

On March 7, 2006, a complaint was filed in the United States District Court for the Northern

District of Alabama (Janet Calvert v. Dolgencorp, Inc., Case No. 2:06-cv-00465-VEH (‘‘Calvert’’)), in

which the plaintiff, a former store manager, alleged that she was paid less than male store managers

because of her sex, in violation of the Equal Pay Act and Title VII of the Civil Rights Act of 1964, as

amended (‘‘Title VII’’) (now captioned, Wanda Womack, et al. v. Dolgencorp, Inc., Case

No. 2:06-cv-00465-VEH). The complaint subsequently was amended to include additional plaintiffs, who

also allege to have been paid less than males because of their sex, and to add allegations that the

Company’s compensation practices disparately impact females. Under the amended complaint, plaintiffs

sought to proceed collectively under the Equal Pay Act and as a class under Title VII, and requested

back wages, injunctive and declaratory relief, liquidated damages, punitive damages and attorneys’ fees

and costs.

On July 9, 2007, the plaintiffs filed a motion in which they asked the court to approve the issuance

of notice to a class of current and former female store managers under the Equal Pay Act. The

Company opposed plaintiffs’ motion. On November 30, 2007, the court conditionally certified a

nationwide class of females under the Equal Pay Act who worked for Dollar General as store managers

between November 30, 2004 and November 30, 2007. The notice was issued on January 11, 2008, and

persons to whom the notice was sent were required to opt into the suit by March 11, 2008.

Approximately 2,100 individuals opted into the lawsuit.

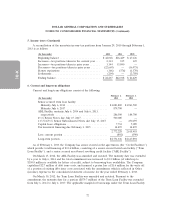

On April 19, 2010, the plaintiffs moved for class certification relating to their Title VII claims. The

Company filed its response to the certification motion in June 2010. The Company’s motion to

decertify the Equal Pay Act class was denied as premature.

The parties agreed to mediate, and the court stayed the action pending the results of the

mediation. The mediation occurred in March and April, 2011, at which time the Company reached an

agreement in principle to settle the matter on behalf of the entire putative class. The proposed

settlement, which received final approval from the court on July 23, 2012, provides for both monetary

and equitable relief. Under the approved terms, $3.25 million was paid for plaintiffs’ legal fees and

costs and $15.5 million was paid into a fund for the class members that will be apportioned and paid

out to individual members (less certain administrative expenses and an additional $3 million in

attorneys’ fees approved by the court on October 24, 2012). Of the total $18.75 million, the Company’s

Employment Practices Liability Insurance (‘‘EPLI’’) carrier paid approximately $15.9 million in the first

quarter of 2012 to a third party claims administrator to disburse the funds, per the settlement terms, to

claimants and counsel in accordance with the court’s orders, which represented the balance remaining

of the $20 million EPLI policy covering the claims. The Company paid approximately $2.8 million to

the third party claims administrator. In addition, the Company agreed to make, and, effective April 1,

2012, has made, certain adjustments to its pay setting policies and procedures for new store managers.

Because it deemed settlement probable and estimable, the Company accrued for the net settlement as

well as for certain additional anticipated fees related thereto during the first quarter of 2011, and

concurrently recorded a receivable of approximately $15.9 million from its EPLI carrier. Due to the

80