Dollar General 2012 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued)

Company’s option at an amount equal to the lesser of fair value or the amount paid for the shares

(i.e., the exercise price). In such cases, because the employee would not benefit in any share

appreciation over the exercise price, for accounting purposes such options are not considered vested

until the expiration of the Company’s call option, which is generally five years subsequent to the date

of grant. Accordingly, all references to the vesting provisions or vested status of the options discussed

in this note give effect to the vesting pursuant to these accounting provisions and may differ from

descriptions of the vesting status of the Time Options and Performance Options located elsewhere in

this report or the Company’s other SEC filings.

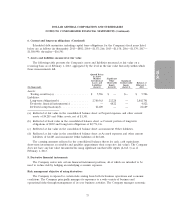

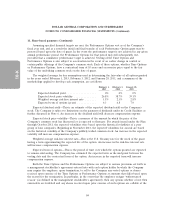

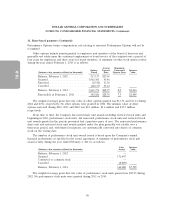

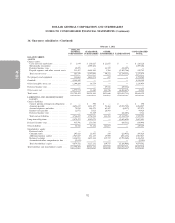

A summary of Time Options activity during the year ended February 1, 2013 is as follows:

Remaining

Average Contractual

Options Exercise Term Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Price in Years Value

Balance, February 3, 2012 ........... 4,258,581 $10.55

Granted ........................ — —

Exercised ....................... (2,861,681) 8.97

Canceled ....................... (46,258) 16.10

Balance, February 1, 2013 ........... 1,350,642 $13.69 5.9 $44,017

Exercisable at February 1, 2013 ....... 723,335 $11.42 5.4 $25,215

The weighted average grant date fair value of Time Options granted during 2011 and 2010 was

$13.47 and $12.61, respectively. The intrinsic value of Time Options exercised during 2012, 2011 and

2010 was $117.3 million, $41.4 million and $5.5 million, respectively.

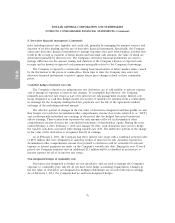

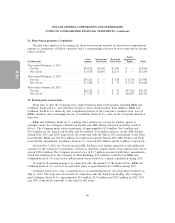

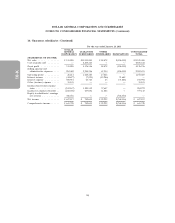

A summary of Performance Options activity during the year ended February 1, 2013 is as follows:

Average Remaining

Options Exercise Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Price Term in Years Value

Balance, February 3, 2012 .......... 3,968,237 $10.75

Granted ....................... — —

Exercised ...................... (2,661,902) 9.12

Canceled ...................... (41,509) 16.87

Balance, February 1, 2013 .......... 1,264,826 $13.96 6.0 $40,879

Exercisable at February 1, 2013 ...... 916,223 $12.61 5.8 $30,850

The weighted average grant date fair value of Performance Options granted during 2011 and 2010

was $13.47 and $12.61, respectively. The intrinsic value of Performance Options exercised during 2012,

2011 and 2010 was $106.4 million, $41.8 million and $14.7 million, respectively.

The Company currently believes that the performance targets related to the unvested Performance

Options will be achieved. If such goals are not met, and there is no change in control or certain public

offerings of the Company’s common stock which would result in the acceleration of vesting of the

85