Dollar General 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

The 2010 effective tax rate of 36.3% was greater than the statutory tax rate of 35%, also due

primarily to the inclusion of state income taxes in the total effective tax rate.

Off Balance Sheet Arrangements

The entities involved in ownership structure underlying the leases for three of our distribution

centers meet the accounting definition of a Variable Interest Entity (‘‘VIE’’). One of these distribution

centers has been recorded as a financing obligation whereby its property and equipment are reflected

in our consolidated balance sheets. The land and buildings of the other two distribution centers have

been recorded as operating leases. We are not the primary beneficiary of these VIEs and, accordingly,

have not included these entities in our consolidated financial statements. Other than the foregoing, we

are not party to any off balance sheet arrangements.

Effects of Inflation

We experienced little or no overall product cost inflation in 2012 or 2010. In 2011, we experienced

increased commodity cost pressures mainly related to food, housewares and apparel products which

were driven by increases in cotton, sugar, coffee, groundnut, resin, petroleum and other raw material

commodity costs. We believe that our ability to selectively increase selling prices in response to cost

increases in 2011 partially mitigated the effect of these cost increases on our overall results of

operations.

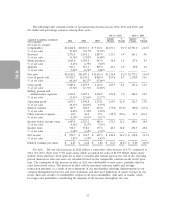

Liquidity and Capital Resources

Current Financial Condition and Recent Developments

During the past three years, we have generated an aggregate of approximately $3.0 billion in cash

flows from operating activities and incurred approximately $1.51 billion in capital expenditures. During

that period, we expanded the number of stores we operate by 1,678, representing growth of

approximately 19%, and we remodeled or relocated 1,671 stores, or approximately 16%, of the stores

we operated as of February 1, 2013. We intend to continue our current strategy of pursuing store

growth, remodels and relocations in 2013 and for the next several years.

At February 1, 2013, we had total outstanding debt (including the current portion of long-term

obligations) of $2.77 billion, which includes our senior secured asset-based revolving credit facility

(‘‘ABL Facility’’ and, together with the Term Loan Facility, the ‘‘Credit Facilities’’), and senior notes, all

of which are described in greater detail below. We had $873.4 million available for borrowing under the

ABL Facility at February 1, 2013.

We believe our cash flow from operations and existing cash balances, combined with availability

under the Credit Facilities (described in greater detail below), and access to the debt markets will

provide sufficient liquidity to fund our current obligations, projected working capital requirements and

capital spending for a period that includes the next twelve months as well as the next several years.

We intend to refinance outstanding amounts under our secured Credit Facilities with new

unsecured long-term debt of up to $2.3 billion, expected to consist of new unsecured term loans and

new unsecured senior notes. In addition, we intend to enter into a new unsecured cash flow based

revolving credit facility, which is currently expected to have no initial revolver borrowings outstanding.

The actual amounts and type of financing is dependent on market conditions and other factors.

Although we currently anticipate completing this financing in the first quarter of 2013, there can be no

assurance that we will complete the refinancing on the foregoing terms or at all.

35