Dollar General 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

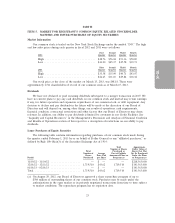

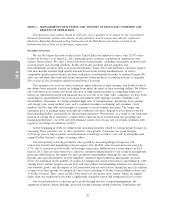

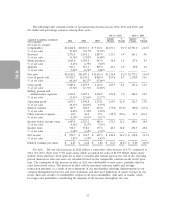

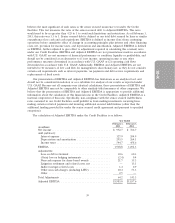

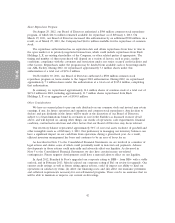

The following table contains results of operations data for fiscal years 2012, 2011 and 2010, and

the dollar and percentage variances among those years.

2012 vs. 2011 2011 vs. 2010

Amount % Amount %

(amounts in millions, except per 2012 2011 2010 Change Change Change Change

share amounts)

Net sales by category:

Consumables ............ $11,844.8 $10,833.7 $ 9,332.1 $1,011.1 9.3%$1,501.6 16.1%

% of net sales ........... 73.93% 73.17% 71.59%

Seasonal ............... 2,172.4 2,051.1 1,887.9 121.3 5.9 163.2 8.6

% of net sales ........... 13.56% 13.85% 14.48%

Home products .......... 1,061.6 1,005.2 917.6 56.4 5.6 87.6 9.5

% of net sales ........... 6.63% 6.79% 7.04%

Apparel ................ 943.3 917.1 897.3 26.2 2.9 19.8 2.2

% of net sales ........... 5.89% 6.19% 6.88%

Net sales ............... $16,022.1 $14,807.2 $13,035.0 $1,214.9 8.2%$1,772.2 13.6%

Cost of goods sold ........ 10,936.7 10,109.3 8,858.4 827.4 8.2 1,250.8 14.1

% of net sales ........... 68.26% 68.27% 67.96%

Gross profit ............. 5,085.4 4,697.9 4,176.6 387.5 8.2 521.4 12.5

% of net sales ........... 31.74% 31.73% 32.04%

Selling, general and

administrative expenses . . . 3,430.1 3,207.1 2,902.5 223.0 7.0 304.6 10.5

% of net sales ........... 21.41% 21.66% 22.27%

Operating profit .......... 1,655.3 1,490.8 1,274.1 164.5 11.0 216.7 17.0

% of net sales ........... 10.33% 10.07% 9.77%

Interest expense .......... 127.9 204.9 274.0 (77.0) (37.6) (69.1) (25.2)

% of net sales ........... 0.80% 1.38% 2.10%

Other (income) expense .... 30.0 60.6 15.1 (30.7) (50.6) 45.5 301.4

% of net sales ........... 0.19% 0.41% 0.12%

Income before income taxes . 1,497.4 1,225.3 985.0 272.1 22.2 240.3 24.4

% of net sales ........... 9.35% 8.27% 7.56%

Income taxes ............ 544.7 458.6 357.1 86.1 18.8 101.5 28.4

% of net sales ........... 3.40% 3.10% 2.74%

Net income ............. $ 952.7 $ 766.7 $ 627.9 $ 186.0 24.3%$ 138.8 22.1%

% of net sales ........... 5.95% 5.18% 4.82%

Diluted earnings per share . . $ 2.85 $ 2.22 $ 1.82 $ 0.63 28.4%$ 0.40 22.0%

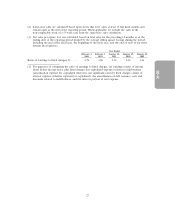

Net Sales. The net sales increase in 2012 reflects a same-store sales increase of 4.7% compared to

2011. For 2012, there were 9,783 same-stores which accounted for sales of $14.99 billion. Same-stores

include stores that have been open for at least 13 months and remain open at the end of the reporting

period. Same-store sales increases are calculated based on the comparable calendar weeks in the prior

year. The remainder of the increase in sales in 2012 was attributable to new stores, partially offset by

sales from closed stores. The increase in sales reflects increased customer traffic and average

transaction amounts, as a result of the refinement of our merchandise offerings, improvements in our

category management processes and store standards, and increased utilization of square footage in our

stores. Increases in sales of consumables outpaced our non-consumables, with sales of snacks, candy,

beverages and perishables contributing the majority of the increase throughout the year.

32