Dollar General 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

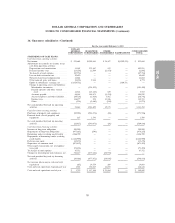

11. Share-based payments (Continued)

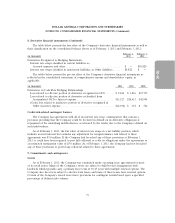

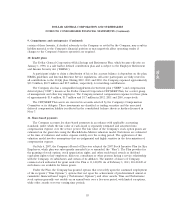

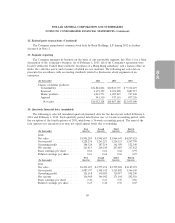

A summary of restricted stock unit award activity during the year ended February 1, 2013 is as

follows:

Units Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Value

Balance, February 3, 2012 ............................. 13,024

Granted .......................................... 305,618

Converted to common stock ........................... (4,873)

Canceled ......................................... (24,842)

Balance, February 1, 2013 ............................. 288,927 $13,372

The weighted average grant date fair value of restricted stock units granted was $45.33 and $33.16

during 2012 and 2011, respectively. No restricted stock units were granted in 2010.

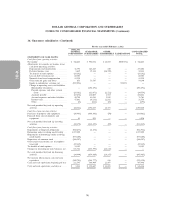

In March 2012, the Company issued a performance-based award of 326,037 shares of restricted

stock to its Chairman and Chief Executive Officer. This restricted stock award had a fair value on the

grant date of $45.25 per share and a purchase price of zero, and may vest in the future if certain

specified earnings per share targets for fiscal years 2014 and 2015 are achieved. The Company will not

begin recognizing compensation cost for these awards until the future periods that the awards relate to,

and then only if the Company believes that the performance targets related to the unvested restricted

stock will be achieved. As a result, this award is not included in the unrecognized compensation cost

award disclosure which follows.

At February 1, 2013, the total unrecognized compensation cost related to nonvested stock-based

awards was $27.7 million with an expected weighted average expense recognition period of 1.7 years.

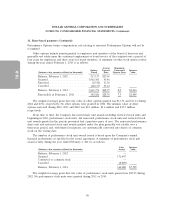

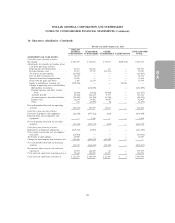

In October 2007, the Company’s Board of Directors adopted an Equity Appreciation Rights Plan,

which plan was later amended and restated (as amended and restated, the ‘‘Rights Plan’’). The Rights

Plan provides for the granting of equity appreciation rights to nonexecutive managerial employees.

During 2011, 818,847 equity appreciation rights were granted, 768,561 of such rights vested, primarily in

conjunction with the Company’s December 2011 stock offering and 50,286 of such rights were

cancelled. No such rights are outstanding as of February 1, 2013.

87