Dollar General 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

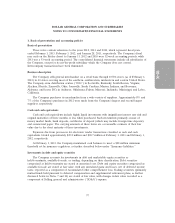

1. Basis of presentation and accounting policies (Continued)

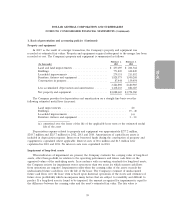

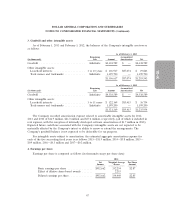

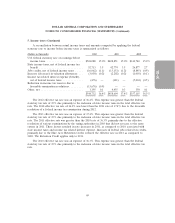

Property and equipment

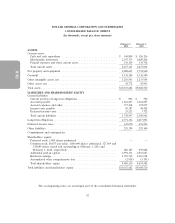

In 2007, as the result of a merger transaction, the Company’s property and equipment was

recorded at estimated fair values. Property and equipment acquired subsequent to the merger has been

recorded at cost. The Company’s property and equipment is summarized as follows:

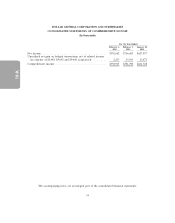

February 1, February 3,

(In thousands) 2013 2012

Land and land improvements ...................... $ 257,695 $ 204,562

Buildings ..................................... 773,835 622,849

Leasehold improvements ......................... 279,351 213,852

Furniture, fixtures and equipment ................... 1,828,573 1,500,268

Construction in progress .......................... 87,444 139,454

3,226,898 2,680,985

Less accumulated depreciation and amortization ........ 1,138,233 886,025

Net property and equipment ....................... $2,088,665 $1,794,960

The Company provides for depreciation and amortization on a straight-line basis over the

following estimated useful lives (in years):

Land improvements ......................................... 20

Buildings ................................................. 39 - 40

Leasehold improvements ..................................... (a)

Furniture, fixtures and equipment ............................... 3 - 10

(a) amortized over the lesser of the life of the applicable lease term or the estimated useful

life of the asset

Depreciation expense related to property and equipment was approximately $277.2 million,

$243.7 million and $215.7 million for 2012, 2011 and 2010. Amortization of capital lease assets is

included in depreciation expense. Interest on borrowed funds during the construction of property and

equipment is capitalized where applicable. Interest costs of $0.6 million and $1.5 million were

capitalized in 2012 and 2011. No interest costs were capitalized in 2010.

Impairment of long-lived assets

When indicators of impairment are present, the Company evaluates the carrying value of long-lived

assets, other than goodwill, in relation to the operating performance and future cash flows or the

appraised values of the underlying assets. In accordance with accounting standards for long-lived assets,

the Company reviews for impairment stores open more than two years for which current cash flows

from operations are negative. Impairment results when the carrying value of the assets exceeds the

undiscounted future cash flows over the life of the lease. The Company’s estimate of undiscounted

future cash flows over the lease term is based upon historical operations of the stores and estimates of

future store profitability which encompasses many factors that are subject to variability and difficult to

predict. If a long-lived asset is found to be impaired, the amount recognized for impairment is equal to

the difference between the carrying value and the asset’s estimated fair value. The fair value is

59